Economic Data Watch and Market Outlook

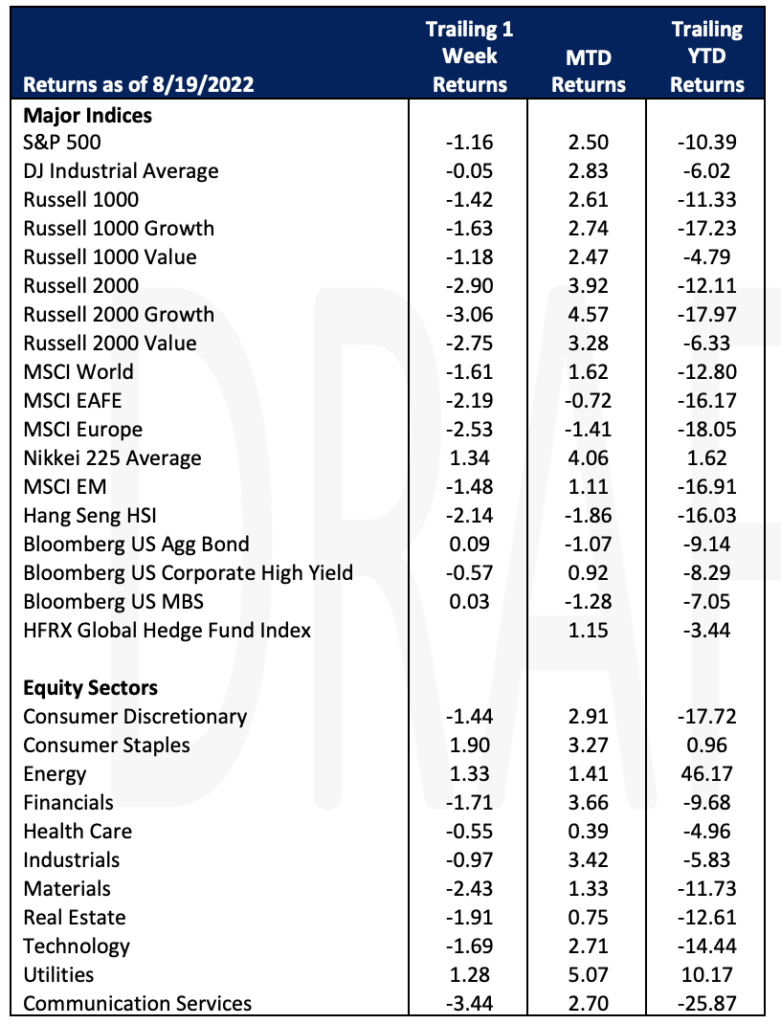

Global asset prices were mostly negative for the week with the S&P 500 falling 1.16%. The Russell 2000, which is comprised of smaller cap names in the US got hit harder, falling 2.90%. MSCI Europe and MSCI Emerging Markets indices fell 2.53% and 1.48% respectively. The Bloomberg Aggregate Bond index rose 0.09%.

The US economy is slowing and could possibly face a recession by end of year according to the Conference Board monthly index. The index often foreshadows developments in the economy by about seven months. The combination of consumer pessimism and slowing labor markets, housing construction, and manufacturing new orders suggest that economic weakness will intensify and spread more broadly throughout the US economy.

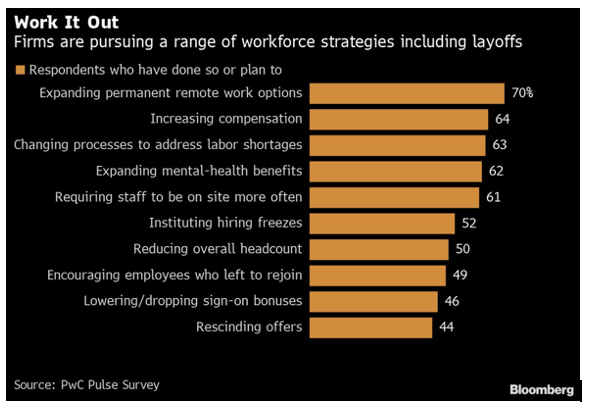

As the economy possibly heads into recession, employers are rethinking their workforce according to a recent PwC survey of 700 corporate executives.

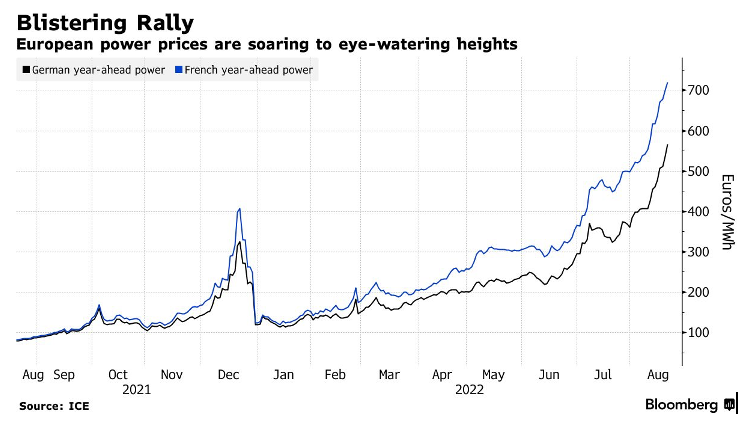

France and Germany are struggling with the impacts of the extended heatwave. The Rhine’s water level has dropped significantly, to the point where coal barges are unable to use the river for transportation. Further, France’s nuclear facilities are unable to flush the high temperature water used for cooling and as a result need to shut down or limit reactor capacity which has caused power prices to surge.

This week we’ll review weekly home sales and mortgage data, but GDP and consumer spending data released towards the end of the week will take center stage. In developed markets data will be released on industrial production as well as the German GDP number, while China will release import and export data and industrial profit results.

Equities

The indices broke their 4-week win streak with the Dow down 0.17%, S&P down 1.21% and Nasdaq down 2.62% for the week. Friday was also option expiration day for over $2 trillion worth of stock and index options which contributed to the volatility in the market.

Retailer and other consumer companies fell Friday as Bed Bath & Beyond shares lost 13.2% for the week due to the sale of 7.78 million shares by Ryan Cohen’s, RC Ventures. Target lost 3.14% for the week due to disappointing quarterly earnings and excess inventory though full year guidance remained intact although Walmart gained 3.61%for the week by beating earnings estimates that they attributed to higher income shoppers buying.

GM announced the reinstatement of their quarterly dividend which was suspended since the start of the COVID 19 pandemic and plans to increase its existing repurchase program of common stock to $5B up from $3.3B leading the stock to rise 2.53% on Friday.

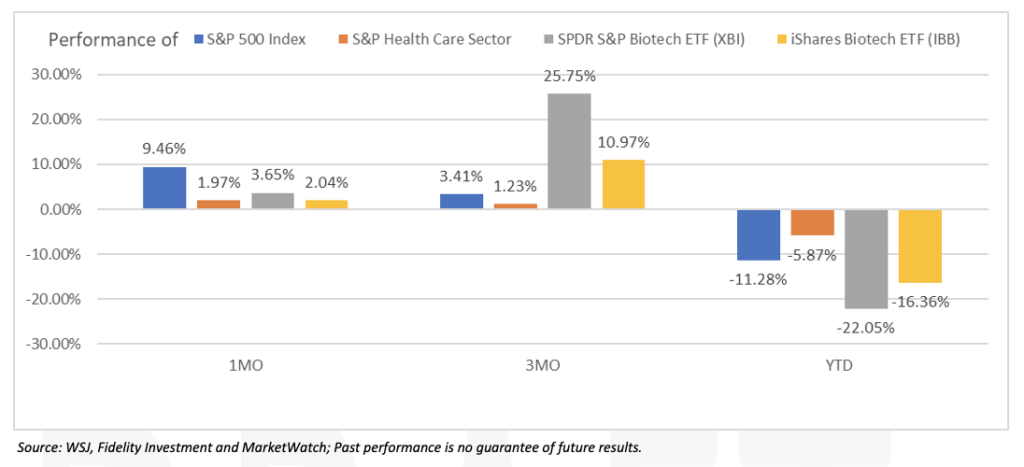

Biotech stocks are receiving some renewed optimism from investors due to biotech merger announcements, potential new drug approvals and buying from big investors, including hedge funds Perceptive Advisors and RA Capital Management (according to the Wall Street Journal dated August 19th). Biotech mergers include Pfizer’s agreement to acquire Global Blood Therapeutics for $5.4B in cash; Amgen’s agreement to acquire ChemoCentryx Inc for $3.7B; and Merck & Co’s potential acquisition of Seagen for $40B.

In addition to biotech merger news, Warren Buffet has received permission to buy up to half of Occidental Petroleum. Shares jumped 10% on the news to close at $71.29, pushing their 2022 gains to more than 145%. Berkshire Hathaway currently owns 188.5 million shares, equal to a 20.2% position as well as $10 billion of Occidental’s preferred stock and has warrants to buy another 83.9 million common shares for $5 billion or $59.62 each.

Fixed Income

US Treasury yields moved higher during Friday’s trading session as investors digested commentary from the Fed and jobless claims data that showed a decrease in claims. The Fed indicated they would continue hiking rates until inflation slows down significantly. The US 10-year Treasury yield rose about 10bps from its close on Thursday to a month high of 2.988%. The yield curve between two and 10-year notes, was at -27.8bps on Friday, its smallest inversion since August 1.

US corporate bonds with “junk” credit ratings have rallied, picking up momentum seen lately in major stock indices as investors bet on a soft landing for the economy. Junk bond spreads last week posted their quickest retreat on record – only 1.2 months – narrowing from roughly 600 bps to 425 bps above the risk-free rate. That marks the quickest spread retreat on record in that range since the ICE BofA US High Yield Index was created.

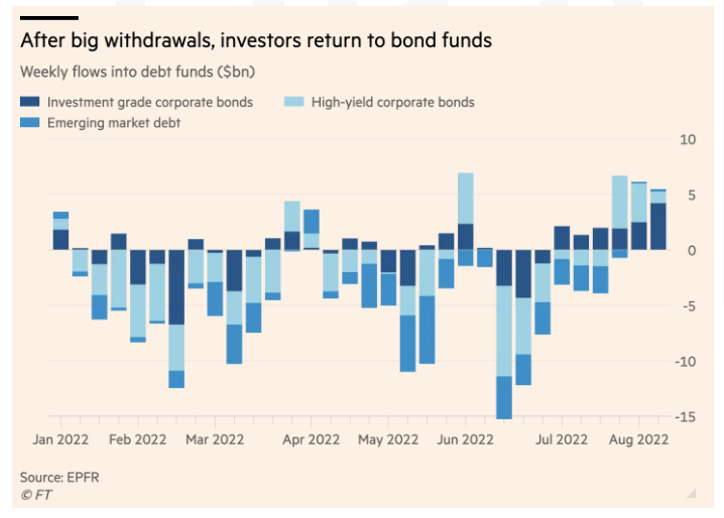

Investors have been optimistic about the outlook of the economy sending traders back into debt markets. Money has pumped into investment grade, high yield, and emerging market debt funds in recent weeks, after sustained outflows since January, according to flows tracked by EPFR.

The mortgage lending industry is seeing lenders beginning to go out of business after a sudden spike in interest rates this year causing mortgage volumes to plunge. Since many banks stopped offering mortgages after the financial crisis, many of these mortgage lenders are independent companies with no government backing and no emergency programs they can tap for financing. The potential string of bankruptcies on the horizon has many market watchers predicting hundreds of thousands of layoffs in this lower rate-dependent industry.

Hedge Funds

Once again, hedge funds had a challenging week but unlike last week where crowded shorts were the cause of the underperformance, this week saw negative alpha from longs across all regions. Americas-based long/short equity funds were the biggest laggards for the week, losing ~90 bps which compares to +10 bps for the S&P 500. The active reduction of gross exposure slowed this week with volumes across the hedge fund community falling to their lowest levels YTD. Hedge funds still trimmed both long and short exposure but not near the magnitude of the prior 2 weeks. In North America, funds continue to trim longs in sectors where net exposure is particularly high such as energy and materials. Hedge funds flipped to selling healthcare, but it mostly came from adding shorts in biotech and pharma. In other regions, HF trimmed long exposure in European equities, were small buyers of China H-shares and continue to de-gross in Japan for the 9th straight week.

Private Equity

After a year of fast-paced deal making, many middle-market private equity firms have switched to “risk-off” mode. After a strong year in 2021, market volatility, rising interest rates and the looming possibility of a recession have led deal makers to change their approach to focus on scaling portfolio companies in which they already own. Analysts report value creation-related PE activities have risen 74% in the first half of 2022, up from 64% in the first half of 2021.

Given the dip in the public markets from last year’s highs, private valuations have started to recalibrate opening the door for smaller deals at lower valuations. Middle-market deal makers are focusing on these add-on acquisitions as strategic and value add to their current portfolio companies. After successfully purchasing and integrating these smaller firms, post-acquisition synergy multiples can be extremely attractive in buy-and-build strategies.

Additionally, analysts conclude that many middle-market firms have placed an increased focus on managing existing portfolios’ cash flows, in contrast to last year when majority of resources were spent on conducting due diligence and new acquisitions. Analysts report due diligence activities fell to 21% in the first half of 2022 as compared to 35% during the same time frame last year. The shift indicates sponsors are prioritizing positioning their portfolio companies for future headwinds. Many firms have hired specialized consulting firms to undertake activities such as product-pricing strategies to keep up with inflation, procurement specialists to help bring down input costs and optimization specialists to make operations more efficient.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s, the Wall Street Journal, Morgan Stanley, Goldman Sachs and IR+M