Economic Data and Market Highlights

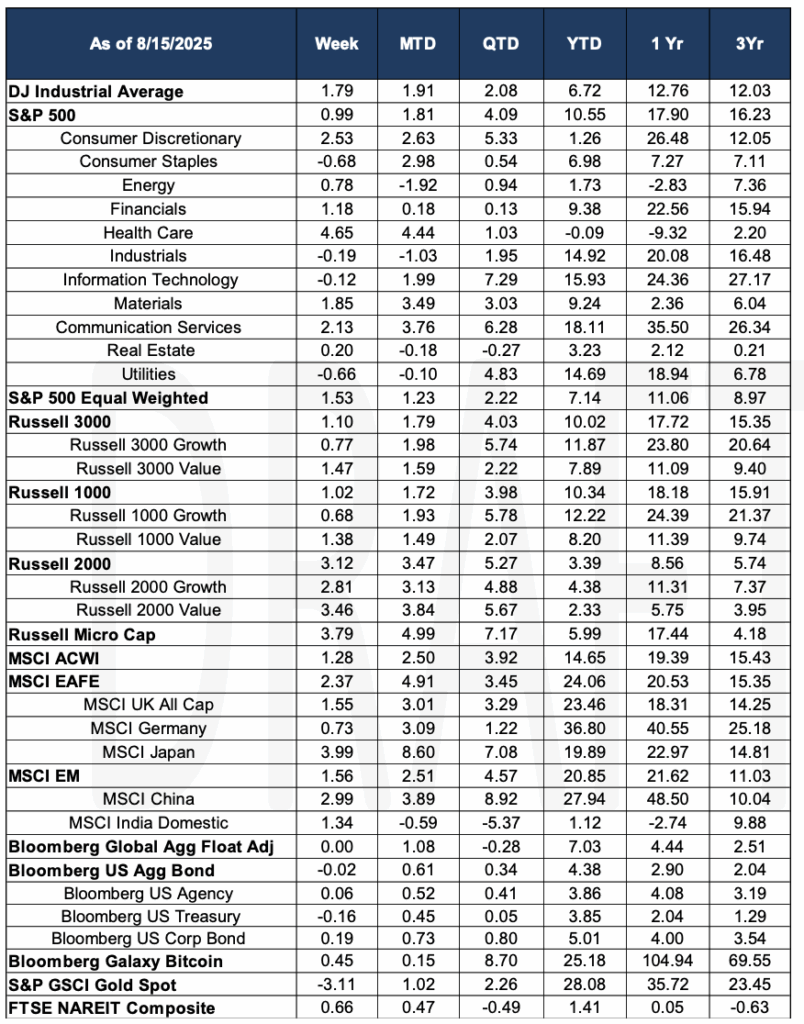

Global equity markets continued to advance upward (MSCI ACWI +1.28%). The S&P500 rose 99 basis points. Small stocks, as represented by the Russell 2000, advanced 3.12% for the week, bringing the year-to-date increase for small caps to 3.39%. Optimism for a rate among smaller companies fueled the rally. Tariffs could play a larger role than a rate cut going forward, but that will likely play out over the coming months. Other trade related costs are starting to play a role in global trade too as Nvidia and AMD agreed to give the Trump administration 15% of their sales of certain artificial-intelligence chips to China to secure export licenses.

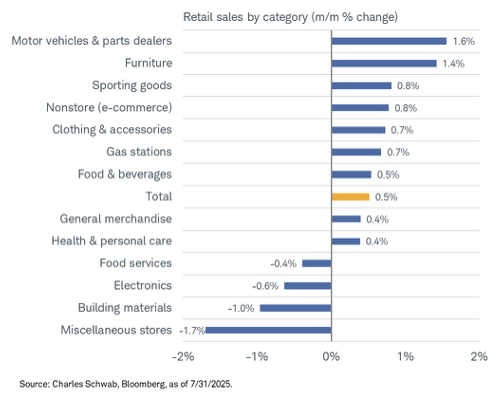

July retail sales came in at 0.5%, below the 0.6% estimate. Last month’s result was revised upward from 0.6%.

Oil slumped on the supply wave. OPEC+ is restoring barrels, and the IEA raised 2025 supply growth to 2.5 million barrels per day from 2.1 million barrels per day, with a weaker demand outlook to 680,000 barrels per day from 700,000 barrels per day, pushing WTI < $63 —a disinflation tailwind but energy-credit headwind. Gas prices in the US averaged $3.13 for the week, down from $3.42 one year ago. Prices this week ranged from $4.49 per gallon (CA) to $2.68 per gallon (MS).

Corporate credit spreads approached record lows mid-week, just one basis point above the 1998 low, suggesting the bond market may be overly optimistic about economic growth.

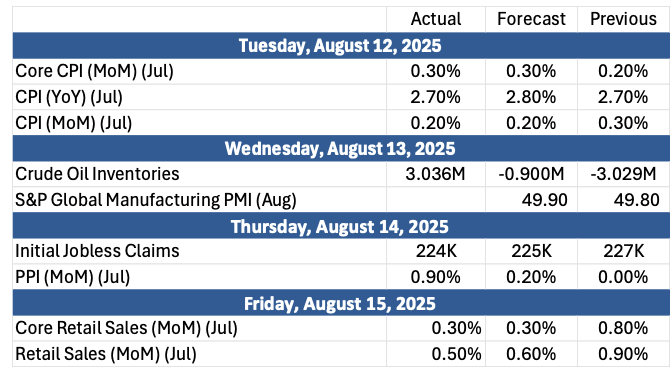

The Past Week’s Notable US data points (with revisions)

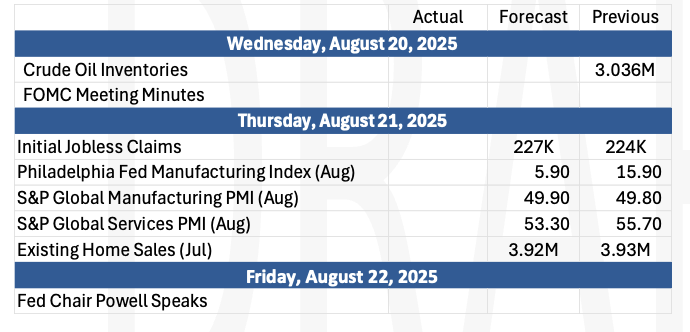

The Upcoming Week’s notable US data points

Source: Morningstar

Data Source: Jim Bianco Research, Charles Schwab and Co, Financial News London, Financial Times, Kobelessi Letter Morningstar, MarketWatch, Standard & Poor’s, and the Wall Street Journal.

Authors:

Jon Chesshire

Michael McNamara