Economic Data Watch and Market Outlook

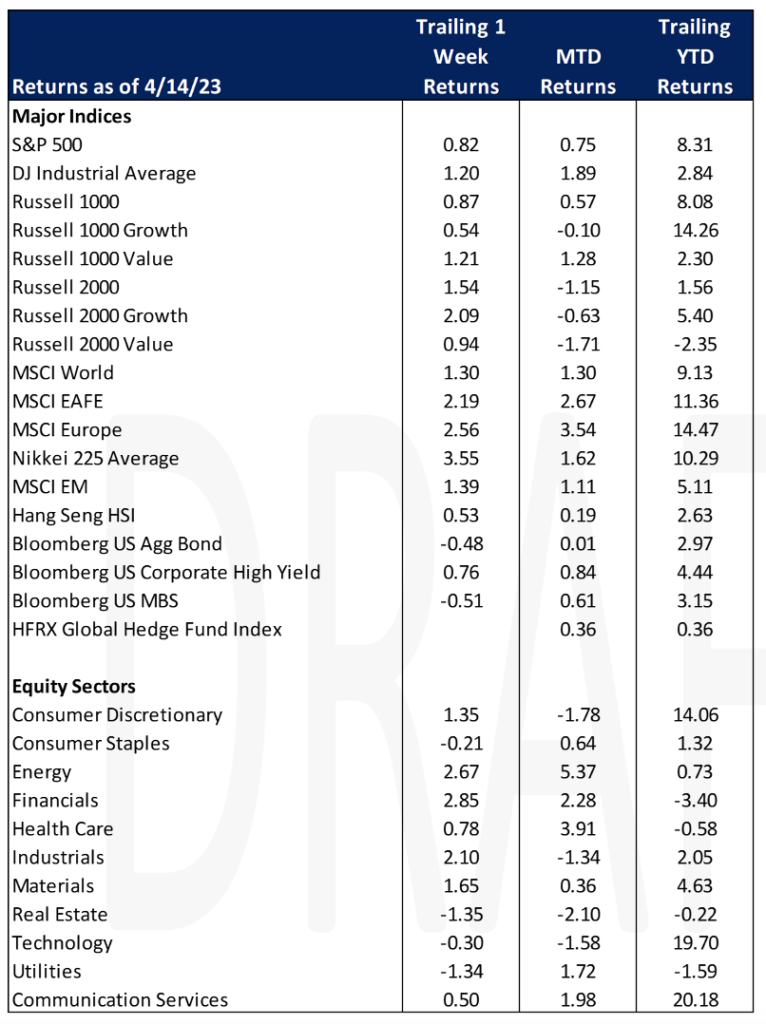

Global Equities rose 1.30% for the week as most developed markets surged. European names rose 2.56% as per the MSCI Europe benchmark. Japanese equities increased (Nikkei 225, +3.55%) while US stocks saw a more modest increase, with the Russell 1000 up 87 basis points. Bonds fell again this week (Bloomberg US Aggregate bond, -0.48%) as economic data came in slightly weaker in some areas but investors were rattled slightly as recent comments from Fed Governor Chris Waller indicated that the Fed may still seek more tightening.

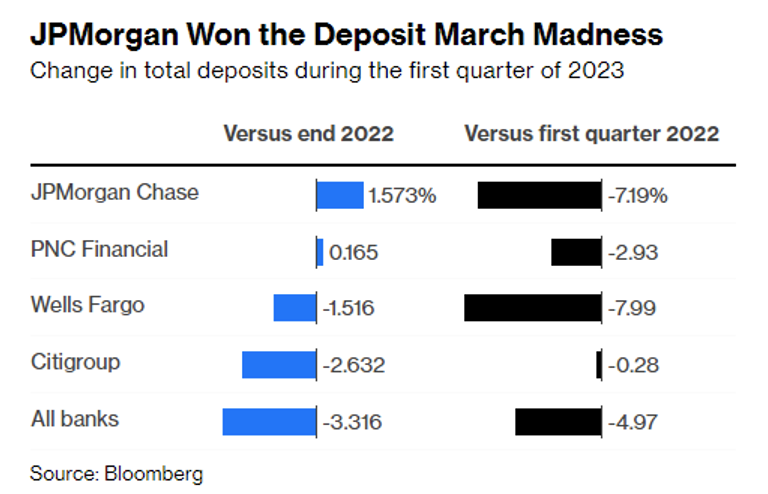

Concerns have settled somewhat around any further banking crisis. As SVB, Signature and others lost deposits, it seems that some of the larger money center banks gained deposits as expected. JPMorgan reported deposit growth of 1.57% in Q1, while PNC Financial saw a slight increase of 0.16%, Citigroup’s deposits fell 2.63%, and Wells Fargo’s deposits fell 1.51%. US banks in total saw deposits shrink by 3.32%.

While stabilization of the banking system is a good sign, smaller banks face greater headwinds. Stock prices of those smaller banks show that investors are wary of their future earnings based on recent stock declines. With fewer demand deposits, smaller banks are not able to lend as freely and are more restrictive on the loans they do make.

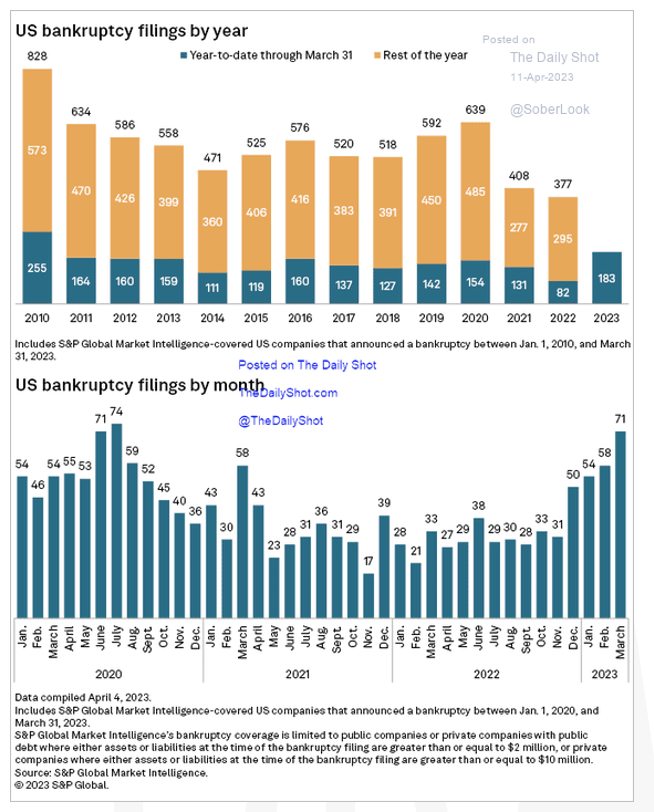

Bankruptcies have picked up in 2023 as the chart below shows the rise of companies with more than $2 million in assets or debt declaring bankruptcy in March.

Treasury Secretary Yellen suggested this past week that the banks will likely help the Fed do its job by becoming more restrictive on lending, thus helping to moderate growth. The Federal Reserve Board’s next meeting is on May 2nd and 3rd.

Equities

US equity markets ended slightly higher for the week (Dow: +1.20%; S&P: +0.82%; Nasdaq: +0.29%)

First quarter earnings reports started Friday as JPMorgan, Citigroup, and Wells Fargo reported earnings. All three banks exceeded earnings expectations and continued to benefit from higher interest rates that allow it to charge more for loans. JP Morgan posted a blowout 52% increase in first quarter profit and record revenue while Citigroup profit increased by 7%. All three banks built up their rainy-day funds in the quarter for a total of approximately $2 bn for potential bad loans.

Blackrock’s first quarter profit was down 19% while the firm’s assets under management rose to $9.1 trillion from $8.6 trillion in the fourth quarter. Net fund inflows reported by the company was $103 billion, which was higher than analyst expectations and a major portion of inflows going into bond funds and exchange traded funds. Performance fees for their actively managed funds slid from $98 million to $55 million.

Spirit AeroSystems, maker of Boeing fuselage, fell after the company said “A nonstandard manufacturing process was used during the installation of two fittings in the aft fuselage section of certain airplanes, creating the potential for a nonconformance to required specifications.” Boeing is pausing deliveries of the 737 Max jets and said the problem would have a significant impact on near term deliveries of 737 MAX 7, MAX 8 and the larger MAX8-200 jets as well as P-8 military reconnaissance planes.

Tesla announced US price cuts and launched a cheaper shorter-range Model Y last week. On Friday, Tesla expanded its price cuts in Germany, France and Israel, adding to concerns about the electric vehicle company’s profit margin.

European equity markets were up for the week (FTSE 100: -+2.76%; DAX: +1.76%; Euro STOXX 600: +2.26%). The FTSE gain was boosted by banks including HSBC Holding.

LVMH Moet-Hennessy Louis Vuitton SE closed at a record high after reporting first quarter sales above expectations spurred by the lifted COVID-19 restrictions and rebounding international travel that drove duty free sales.

Dechra Pharmaceuticals, a veterinary pharmaceuticals maker, announced that it has entered into talks with private equity group EQT for a possible $5.8B all cash deal.

Asian equity markets were up for the week (Hang Seng: +0.76%; Nikkei: +3.55%; Shanghai: +0.32%). Warren Buffet, Berkshire Hathaway CEO, said that it had increased its stakes in five Japanese trading companies to 7.5% each. Trading companies are a group of conglomerates that traditionally acted as facilitators of trade but have evolved into diversified holding companies.

Fixed Income

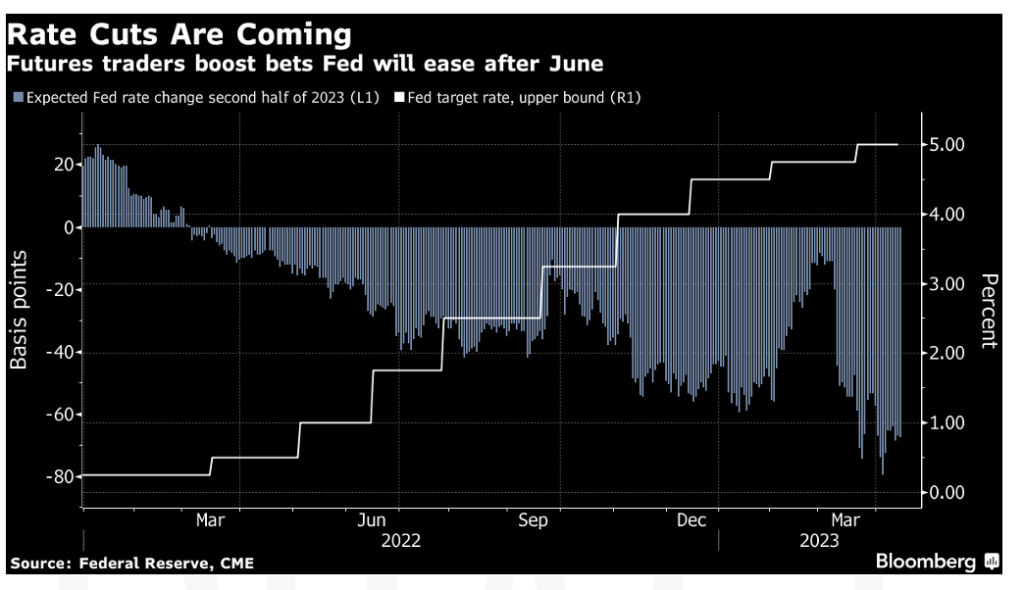

Treasury yields rose throughout the week with the 2-year Treasury yield rising 11 bps, the 10-year Treasury yield rising 7 bps, and the 30-year Treasury yield rising 5 bps. The Bloomberg US Aggregate Bond Index fell -0.48%, the Bloomberg US Corporate High Yield Index rose 0.76%, and the Bloomberg US MBS index fell -0.51%. Volatility in US government bonds has fallen off in April after it reached historical levels in March. From March 9th to March 27th, daily moves in the 2-year Treasury yield averaged 0.22 percentage points, making it the most volatile stretch for bonds since the GFC. Since the 27th of March, daily moves on the 2-year have fallen to 0.07 percentage points. Looking ahead to the Fed’s next meeting on May 3rd, investors expect to see another rate hike, with futures showing that this could be the last hike in the tightening cycle. Furthermore, a survey by the International Association of Credit Portfolio Managers showed that 4 out of 5 respondents expect a recession in the US by the end of 2023.

Deposits at US commercial banks rose during the start of April with Federal Reserve data released Friday showing commercial bank deposits climbed to $17.42T from $17.35T from a week earlier as of April 5th. Inflows were spread between the 25 largest banks as well as small and medium sized banks. Currently deposits at the largest banks are above the levels prior to the collapse of Silicon Valley Bank, while small banks are still short of those levels.

Hedge Funds – As of Thursday 13th

All indices we track in this section each week were up over 1% while hedge funds in those regions all posted positive returns but well under 1%. The MSCI World was up 140 bps compared to 37 bps for global funds and 68 bps for global long/short equity funds. In Europe, the Euro STOXX 600 was +120 bps vs. 37 bps for the average EU fund. In the US, the S&P 500 was +100 bps while US long/short equity funds returned +68 bps. Asia-based funds had the best relative performance at +290 bps vs. +550 bps for the MSCI Asia Pacific. Flows were light this past week, but funds tilted towards buying global equities in small amounts mostly in NA and Japan. In NA, a large portion of the buying was funds covering ETF shorts. Regarding single-names in NA, funds bought cyclicals and sold defensive sectors. In the EU, it was pretty quiet, but funds continued to sell consumer related sectors and technology. In AxJ, flows were mixed with buying in Korea, Australia and Taiwan and selling in China (H-shares). As noted above, HFs were buyers of Japanese equities, with the buying this past week the largest seen since early January. At the sector level, the buying was mix of long adds across financials, industrials, and consumer discretionary and ETF covers. Net leverage for US long/short equity funds sits at 47%, near 12-month highs but well below longer-term levels.

Private Equity

2023 has not been kind to climate tech startups which has seen funding slow to its lowest point in almost 3 years. In Q1 VC funding to climate tech startups raised $5.7 billion across 279 VC deals per Pitchbook data. This translates to a 31% decline in deal count and a 36% decline in deal value from its height in Q3 2021. VC in general has seen significantly less deals in 2022 but still surpassed the $200 billion mark reaching $209.4 billion which would make it the second highest year ever for VC investment per data from EY.

Less VC funding into climate tech startups will only slow the energy transition. Climate tech startups were amongst the winners in the VC space last year raising $13.8 billion in VC deals compared to $14.1 billion in 2021 only losing 2% in funding. The Inflation Reduction Act passed in August of 2022 will only help climate tech companies which aims to reduce energy costs and emissions, invest in rural communities and environmental justice, and increase energy security. The bill passed for $369 billion and is positioned to reduce US greenhouse gas emissions by 40% of 2005 levels by 2030.

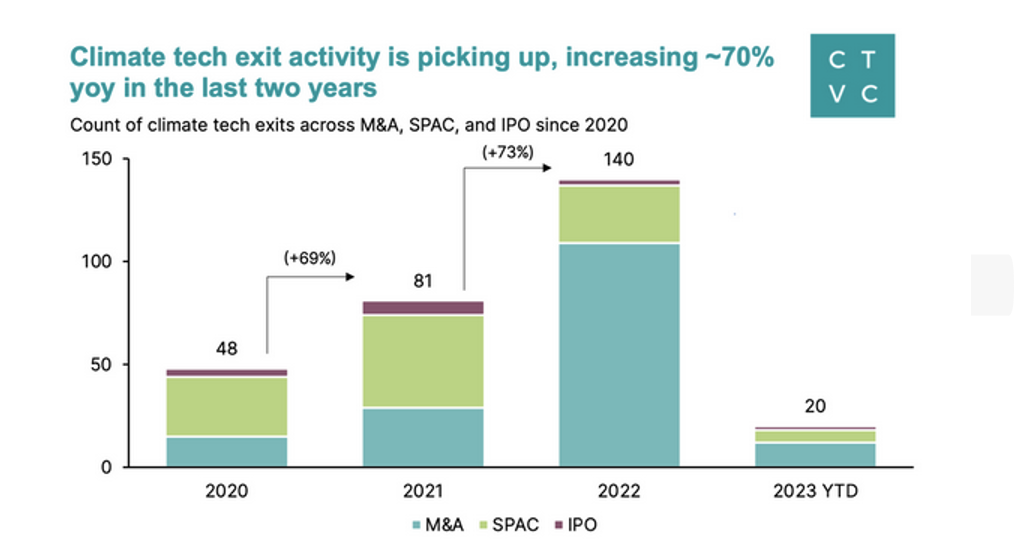

Flows recently into the VC climate tech space have been lagging but there have been 289 climate tech exits from January 2020 to February 2023 per CTVC. Their study found 289 climate tech companies have exited via M&A, SPAC, and IPO since 2020. Climate tech exit activity increased 70% year over year in the last two years. The median time from founding to exits is nine years and the top acquirers were mostly large energy companies and private equity firms. Transportation and energy companies led the exit count at 186 making up 64% of exits. Climate tech exits have been steadily increasing along with funding. The number of IPO’s, SPACs and M&A transactions increased by 70% year over year in 2021 and in 2022. The SPAC market has cooled down post the peak in 2021 but M&A became the largest segment of exits last year which tripled the number of deals compared to 2021. From 2020 to Feb of 2023 M&A accounted for 57% of all exits within climate tech. Only a few companies went public through the traditional IPO route which peaked at seven in 2021 with Rivian’s $66B offering leading the way.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Goldman Sachs, Jim Bianco Research, Market Watch, Morgan Stanley, Morningstar, Pitchbook, Standard & Poor’s and the Wall Street Journal.