Economic Data Watch and Market Outlook

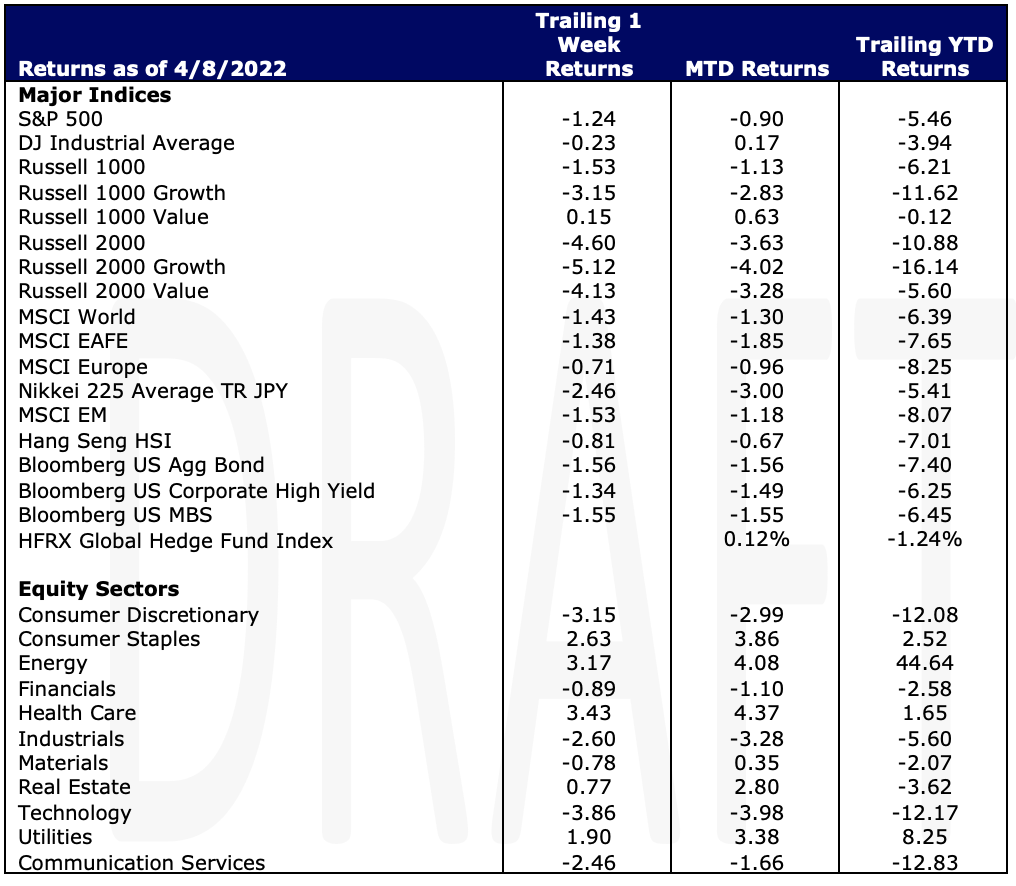

Global stocks fell 1.43% for the week erasing the modestly positive start for the quarter. As of Friday’s close, the MSCI World Index has fallen 6.39% for the year. The US Aggregate Bond Index has fallen 7.39% year to date.

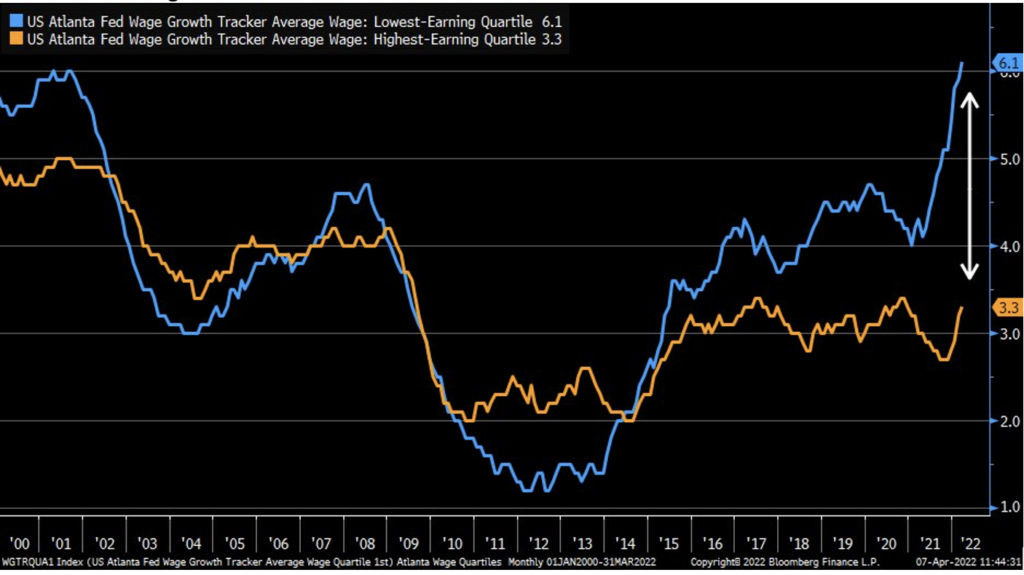

While the US Economy is at virtually full employment, wage growth has also accelerated especially in lowest earning workers according to the Atlanta Fed’s Growth tracker.

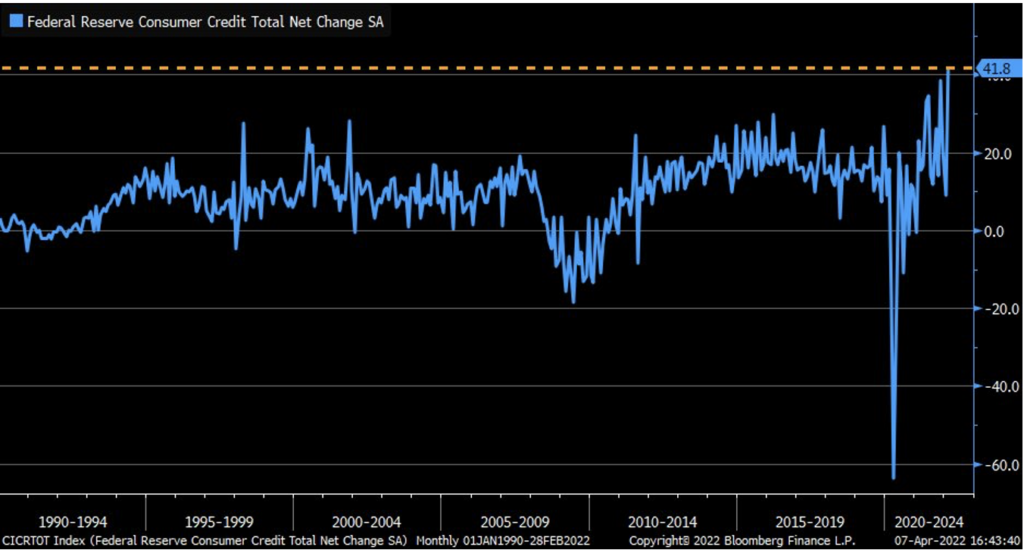

Despite earnings surging, consumer borrowing has also surged, the most on a month over month basis. The data reported by the Federal Reserve also included revolving credit such has credit cards.

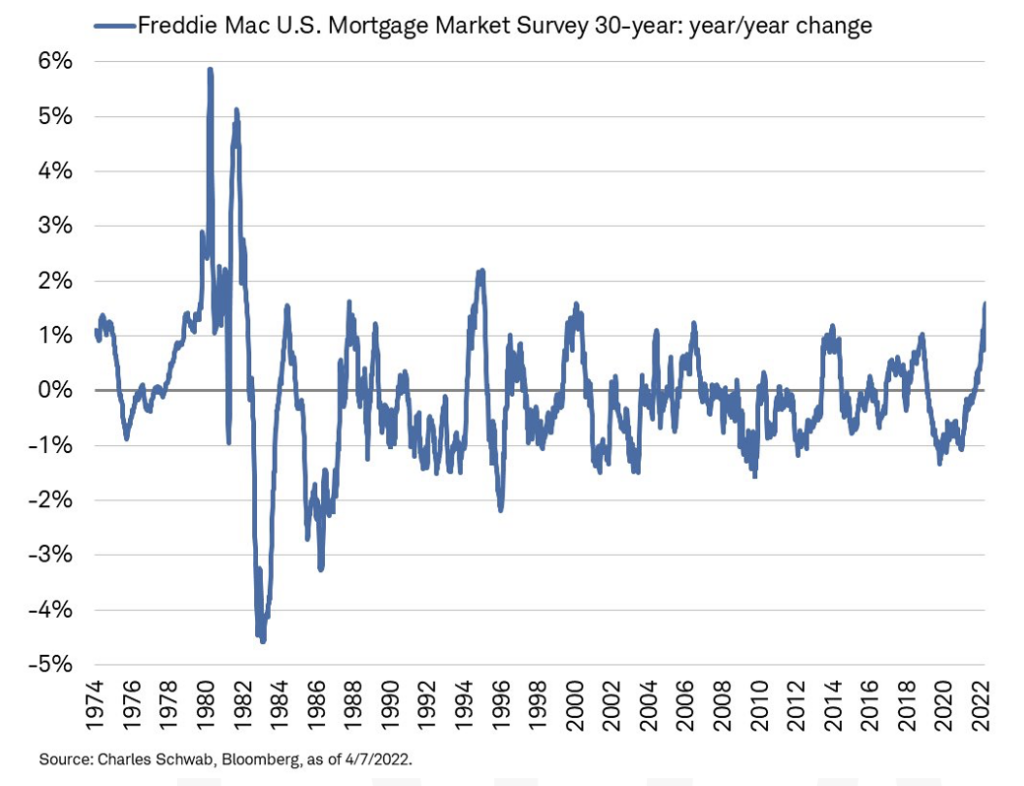

The US Consumer has much to contend with as food prices soared and fuel prices remain elevated. Mortgage rates have also surged, posting the biggest annual gain of 1.59% since February 2000.

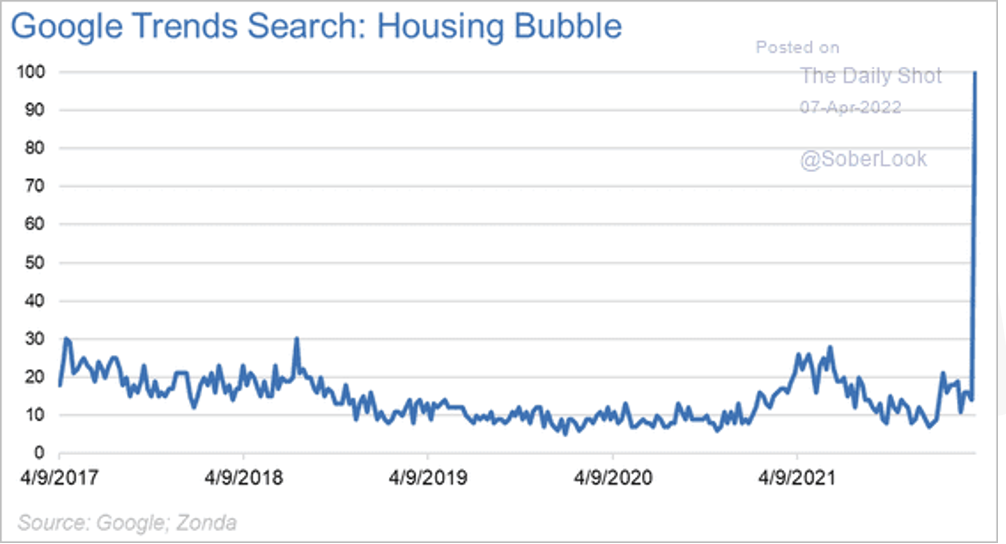

Despite this data, along with Google search showing a skyrocket search for “Housing Bubble”, we believe that the consumer still remains in a good place. Credit terms still remain much tighter than in pre-2007 levels and interest carrying costs are still lower.

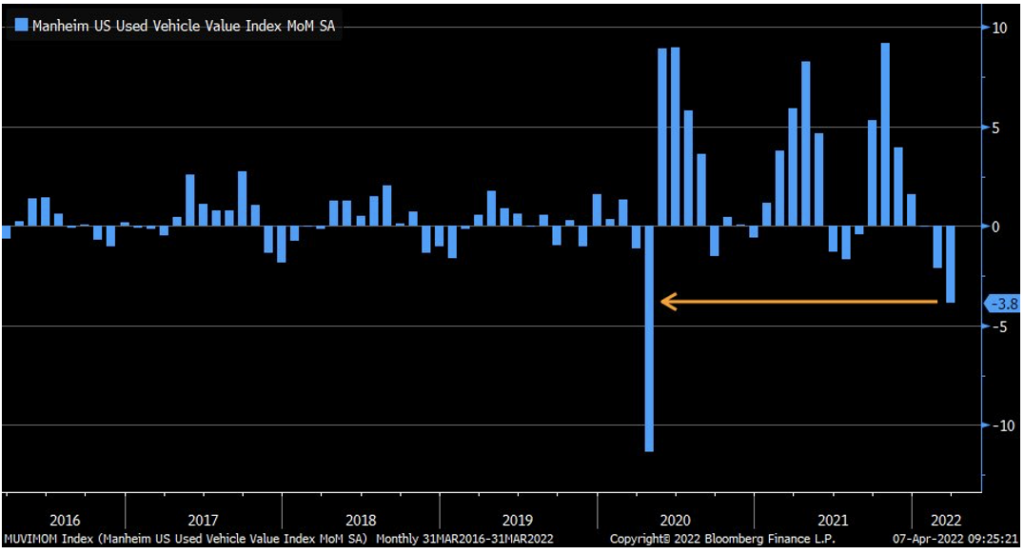

We’ve also started to see Used Car prices drop. March prices fell 3.8%, the largest since March of 2020 according to Manheim, one of the largest used car distributors.

We continue to be mindful that the US consumer has built a stronger balance sheet and will hopefully be able to weather inflation and a potential recession successfully. As we have discussed in recent weeks, the surge in food prices have started to take their toll on some emerging markets as media reports show political uprisings in Peru and Sri Lanka. Disruptions have also started to occur in China as COVID lockdowns are creating issues with food distribution.

This week the U.S. Treasury Department cut off Russia’s ability to make debt payments in dollars held at U.S. Banks. Russia must now choose to pay debt with any dollars held in reserve, new revenue coming in, or default. The additional sanctions have come after media reports and ongoing investigations of war crimes. The Russian ministry of Finance attempted to make a $649 million payment towards two bonds held at JP Morgan Chase, but the payment was not accepted. In turn, Russia has transferred the funds into a bank account with Russia’s national Settlement Depository, the country’s security regulator where they will be held in rubles. The ministry stated that once they gain access to foreign exchange markets, they will allow bondholders to convert the ruble payment back into dollars or euros. Access to foreign markets in the near term is not likely. The U.S. also put sanctions on two of Russia’s largest banks, Sberbank and Alfa Banks, banning all new investments into Russia. The concern by Russia is that a default could lead to banks foreclosing on significant real estate holdings owned by Russian officials, their families and entities they control.

Equities

The U.S. Equity markets ended the week in negative territory following a difficult week of analyzing Fed comments. The S&P 500 slid -1.24% on the week while the Dow closed down -0.23% and the tech-heavy Nasdaq ended down -3.86% – extending its year-to-date underperformance vs. the other major indexes.

Tech stocks have come under pressure in an environment of rising interest rates – investors have dumped riskier stocks as an effect. Chipmakers like Nvidia and Micron, which have struggled amid supply chain shortages and concerns of an impending recession, dipped -4.5% and -1.4%, respectively, while shares of Tesla, Alphabet, and Apple slid -3%, -1.9%, and -1.2% lower on Friday. Transportation stocks, which are often viewed as an indicator of the health of the economy, have been tumbling. Moreover, this week investors were bracing for more aggressive monetary policy to fight inflation per Fed comments; Wednesday’s release of the Fed’s minutes outlined plans to reduce the balance sheet alongside interest rate hikes. Small-caps and growth stocks lagged considerably this week with the Russell 2000 sliding -4.6% on the week while the Russell 2000 Growth slid -5.12%. Healthcare +3.43% and Consumer Staples +2.63% sectors rallied this week as investors worried about a slowing economy pivoting toward stocks with stable earnings. Merck and UnitedHealth Group inched higher again on Friday. Both stocks closed the week +5% and +6.5% higher, respectively. However, overall sector performance within the S&P 500 was generally mixed. Tech -3.86%, Consumer discretionary -3.15%, Industrials -2.60%, and Communication services -3.15% all registered steep losses. Globally, stocks remained negative considering Fed comments, ongoing geopolitical tensions, and China’s increasing COVID cases. The MSCI World ended the week down -1.43% while Europe registered a modest -0.71%. The Nikkei slid -2.46% on the back of aforementioned global concerns.

Fixed Income

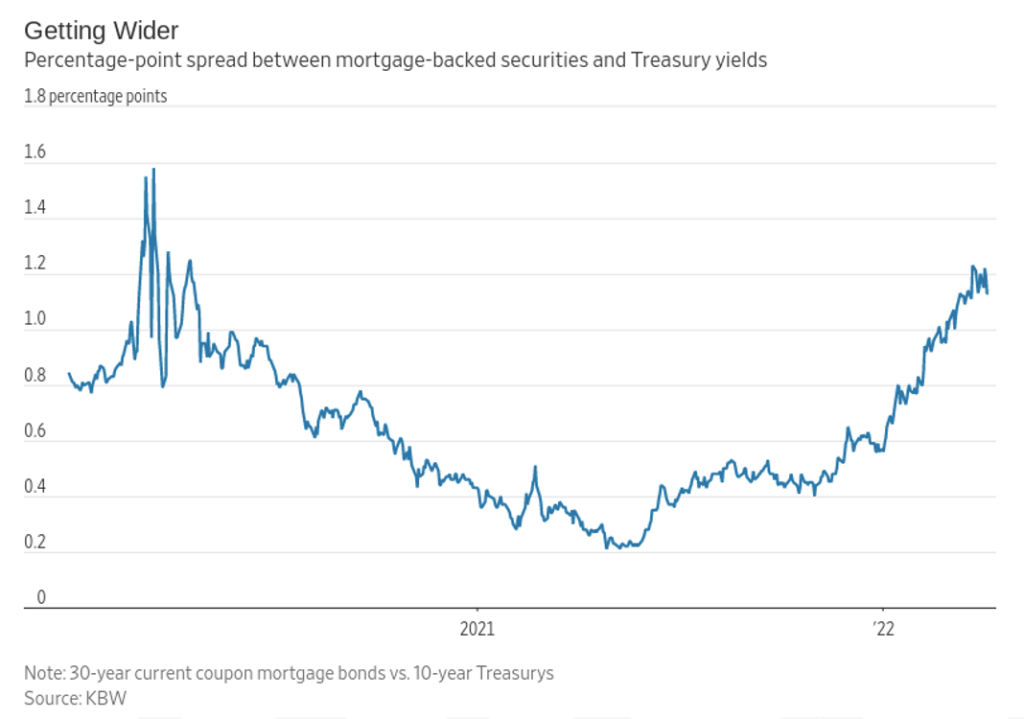

The MBA mortgage application index declined 6.3% last week which is the 4th straight down week led mostly by the refinance index by 9.9%. As the Fed begins to tighten, refinancing on mortgages will drop as so many home buyers took advantage of the historically low rates during Covid. The average 30-year fixed mortgage rate continues to rise ending Thursday at 4.72% from 4.67% last week and 3.13% a year ago. This has led to refinance application volume to be down roughly 60% from a year ago. Home purchases are holding up comparatively better, only 9% below the levels seen last year. Demand for homes remains high but there are supply constraints limiting purchases which in effect drives up the price of homes. How is this effecting the MBS market? The Fed outlined how it will let its balance sheet run off with maturing bonds which means the MBS portion of the portfolio will shrink roughly $35 billion each month. Things get tricky if the Fed starts selling these Mortgage-backed bonds.

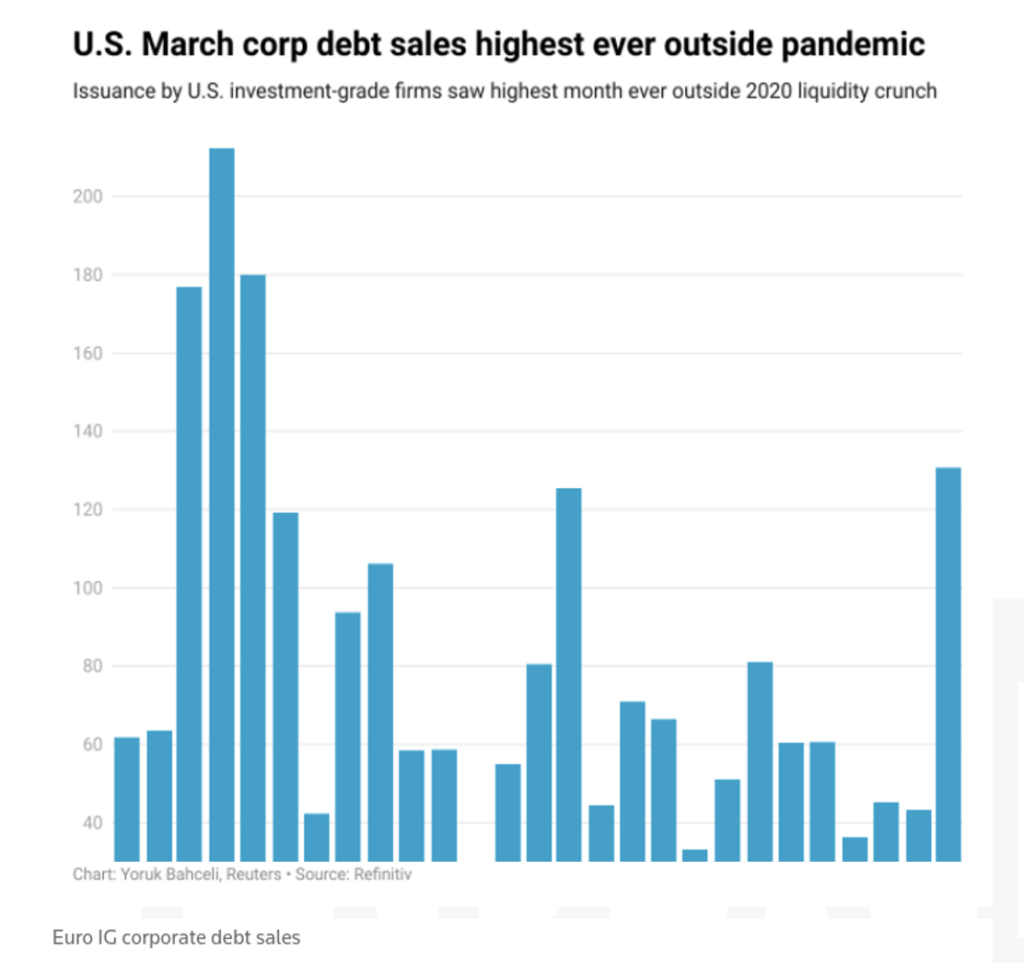

Above is a chart of the spread between the current coupon of the 30-year mortgage-backed securities and the 10-year Treasury Bond yield. The spread has increased dramatically this year indicating a decrease in mortgage bond demand. We will need to see how the Fed’s moves impact the housing market. This comes as moves in Treasuries have been very volatile as well in recent weeks as we saw an inversion last week. The 10-year Treasury hit a 3 year high at 2.72% on Friday following the release of the Fed meeting minutes that stated it plans to shrink its balance sheet by $95 billion each month. The Fed’s aggressive plan to raise rates combined with record high inflation has seen flows out of shorter Treasuries and into longer maturing government debt. Investment grade corporate debt saw its largest monthly issuance since the start of Covid with $130.6 billion issued in March taking advantage before rates really begin to rise. March issuance picked up when credit markets finally found their footing. The opposite is the case in Europe which saw investment grade issuance at 93.6 billion Euros for Q1 which is the worst first quarter since 2018. Below investment grade bond issuance in March were rare to none in Europe while the U.S. was not much higher with only $10.6 billion issued. Issuance for Q1 slumped 70% compared to Q1 2021 which is the slowest since 2016 for the U.S. and 2019 in Europe.

Hedge Funds

Hedge funds started April in a similar fashion to how they ended March – selling global equities. That said, the selling came more from adding short exposure than selling longs, though they were selling longs too. On a relative basis, North America and Europe were the most sold. In North America, the selling came away from traditional TMT where most of the selling had been in March. Healthcare was the most net sold single sector followed by industrials, consumer discretionary and real estate. Hedge funds were net buyers of ETFs in North America. In Europe, the short additions were the most seen in multiple years. In AxJ and Japan, funds net sold but in smaller amounts. In AxJ the selling was concentrated in TMT related industries, mostly China and Taiwan.

Across all strategies globally, hedge funds are holding up reasonably well down 50 bps compared to -130 bps for the MSCI World Index. Asia-based hedge funds have been the top performers on both their absolute and relative performances. Funds are flat MTD compared to the MSCI Asia Index declining 250 bps, more than North America and Europe where funds in both regions are down on the month. Challenges in North America and Europe can be explained by the underperformance of crowded longs where crowded longs in Asia are down less than the other regions and less than shorts in the region, continuing the positive spread.

Private Equity

Although for the past several years venture mega-funds, or funds with commitments of $500 million or more, have been a major trend within the industry, micro-funds are also thriving. Micro-funds, or funds raising $50 million or less, reached 339 closes in 2021 equating to $5 billion in commitments, a new record.

Despite the growing divide between micro-funds and the mega-funds which drive the majority of venture fundraising in the U.S., micro-funds are offering benefits to early-stage companies, emerging managers and limited partners that larger funds cannot. Data shows that the spread of venture capital outside of the main geographical and industry focus areas is heavily influenced by micro-funds. Micro-funds tend to be raised in smaller markets, giving strong opportunities for these funds to invest in less-expensive deals than those seen in San Francisco or New York therefore expanding access to venture capital for seed stage companies and small limited partners alike.

Despite growing valuations and deal sizes as an industry trend in recent years, micro-funds will continue to fuel the venture pipeline and industry. Though data on financial returns of micro-funds is limited, sample data does show a strong return profile which promotes analysts’ confidence in this strategy. Coupled with continued growth of micro-funds and the growing proportion of micro-funds raised by established managers, analysts suspect these funds will likely perform well against benchmarks..

Data Source: Bloomberg, CNBC, the Daily Shot HFR (returns have a two-day lag), Financial Times, Fund Fire, Morningstar, Pitchbook, Standard & Poor’s, the Wall Street Journal, Morgan Stanley, and IR+M

| This report discusses general market activity, industry, or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. It is for informational purposes only and does not constitute, and is not to be construed as, an offer or solicitation to buy or sell any securities or related financial instruments. Opinions expressed in this report reflect current opinions of Clearbrook as of the date appearing in this material only. This report is based on information obtained from sources believed to be reliable, but no independent verification has been made and Clearbrook does not guarantee its accuracy or completeness. Clearbrook does not make any representations in this material regarding the suitability of any security for a particular investor or the tax-exempt nature or taxability of payments made in respect to any security. Investors are urged to consult with their financial advisors before buying or selling any securities. The information in this report may not be current and Clearbrook has no obligation to provide any updates or changes. |