Economic Data Watch and Market Outlook

Despite US markets being closed for Good Friday, Treasury yields and the US dollar rose after March nonfarm payrolls were released. Data showed that the US economy added 236,000 jobs in March, just under expectations of 238,000, while the unemployment rate fell to 3.5% from 3.6%. The yield on the 10-year Treasury note rose 8 basis points to 3.37%, while the 2-year yield rose 10 basis points to 3.91%. The ICE USD Index gained 0.3% to 102.29.

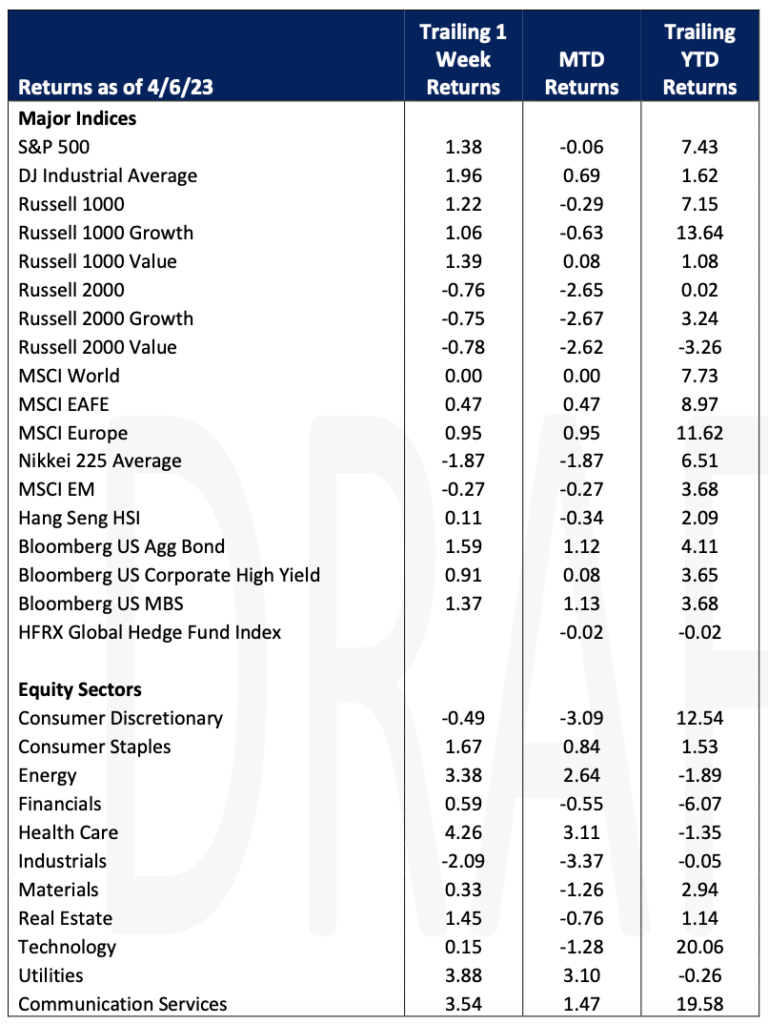

For the week, large-cap US equities, as indicated by the Russell 1000 benchmark, rose 1.22%. Small cap names sank as the Russell 2000 benchmark declined by 76 basis points. International equities rose 47 basis points. Emerging markets stocks fell 27 basis points. The US Aggregate Bond Index rose 1.59%.

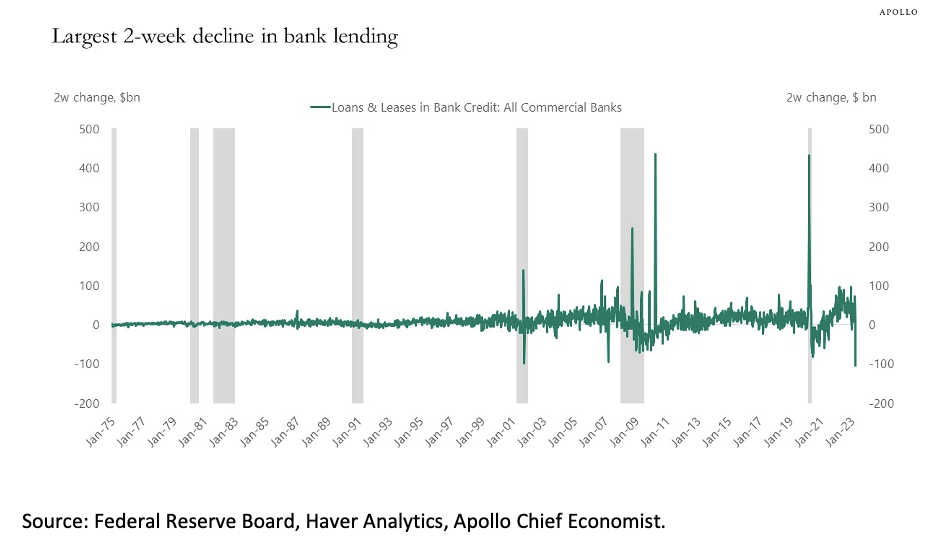

Ripple effects are still being felt after the collapse of Silicon Valley Bank. The chart below indicates the largest two-week decline in lending in history.

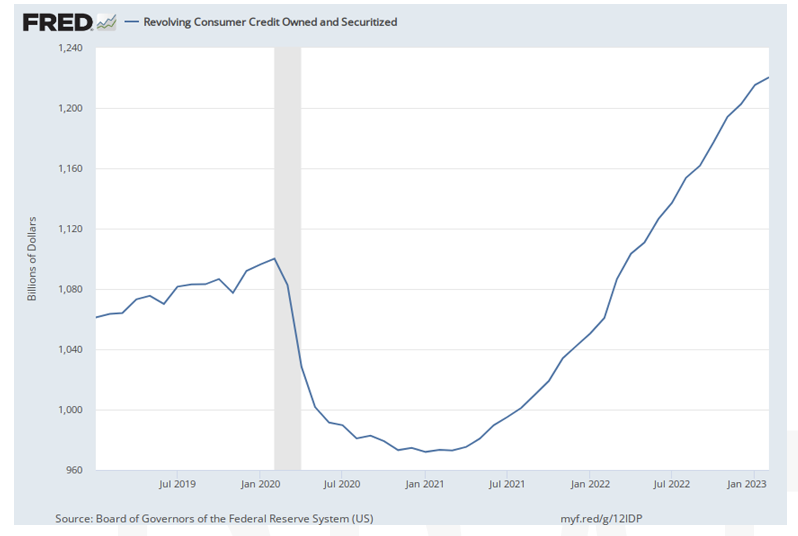

The drop in lending is not only because there is a concern about the consumer. As we have noted in previous commentaries, consumer revolving credit has jumped significantly in recent months as the chart below indicates, but also because of the flight of capital away from banks to higher yielding money market vehicles. As demand deposits decrease, the banks have less lending capacity and, in turn, limit their lending.

Saudi Arabia noted last week that it would cut crude production in an effort to keep prices higher. This move was supported by Russia, Iraq and the United Arab Emirates.

Tensions increased between Taiwan and China as China conducted military drills after Taiwan president Tsai Ing-Wen met US House speaker Kevin McCarthy. Some US lawmakers are grabbing headlines suggesting that US troops be sent to the island.

Western markets outside of the US are closed Monday to celebrate the Easter holiday. This week the US markets will learn more about mortgage growth, CPI data, and later in the week, PPI and jobless claims.

Data Source: Bloomberg, BBC, Charles Schwab, CNBC, the Daily Shot HFR (returns have a two-day lag), Jim Bianco Research, Market Watch, Morningstar, Pitchbook, Standard & Poor’s and the Wall Street Journal.