After riding out the Great Recession, many Endowments & Foundations and other Investment Funds having to tell donors and beneficiaries that they had lost as much as 50 percent of the corpus, trustees and investment committees understandably wanted to look for alternative ways to work with their advisors to “Rightsource℠” the Consulting process while sharing more of the Fiduciary responsibility.

An on-going and growing trend of the outsourced chief investment officer, or OCIO, has emerged from the ashes of the financial meltdown. As an early adopter to this market, we have amassed a significant amount of experience for investors today looking for that added layer of expertise and Rightsourcing.

Innovation Seeking Alpha

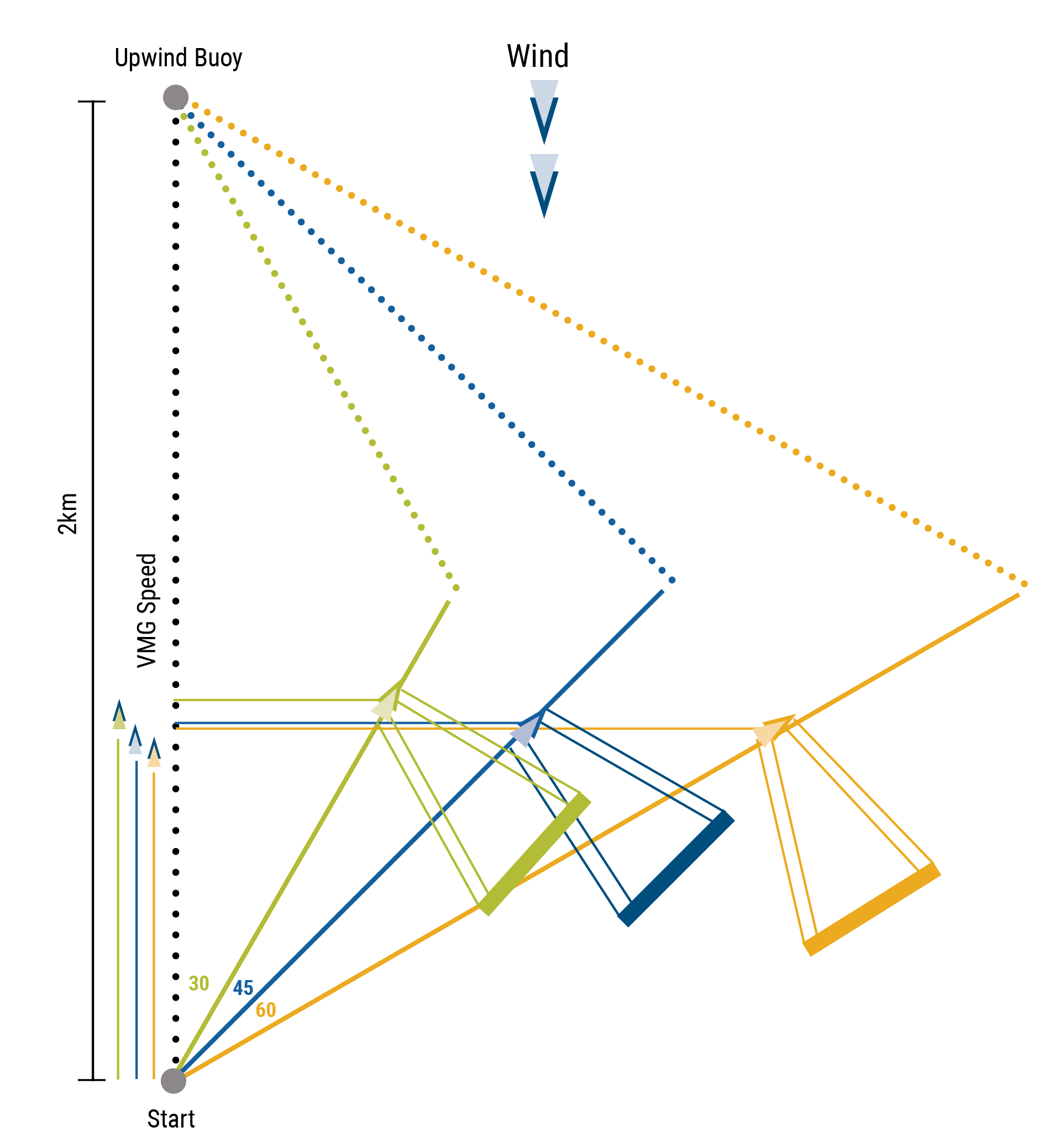

For any Endowment, Foundation and/or Investment Pool looking for outside investment support from consultants, the key is to find an OCIO that can Rightsource the OCIO process to meet an investor’s financial goals. There is no one-size-fits-all strategy that works for all clients. OCIO candidates are required to be nimble in an ever-changing market. To borrow a sailing term, we call this “velocity made good.” If you are sailing to London from New York, you could never do so in a straight line or on the same course every time. Rather, you need to consider currents, wind, the earth’s curvature and many other aspects to make sure you are sailing the boat as fast as possible toward your end game, optimizing your situation.

Do the Right Thing

Similarly, successful investing is never a straight line. There are always pullbacks, resets and downturns that accompany the upswings. The key is how an OCIO firm manages the fluctuations of our volatile markets. That is why we do not talk about five-year targets with our clients; we talk about six-month tactical plans that allow us to change as the markets change. We have always enjoyed the agility that comes with being a boutique or smaller-sized operation because we just don’t have as many hurdles to pass through internally in order to make smart and quick decisions for our clients. This allows us to customize portfolios for our OCIO clients because each and every one of them have nuances that are unique to their organizations. Portfolio strategy today needs to be flexible. Unfortunately, in today’s whipsawing market, ‘set it and forget it’ strategies are disastrous. It is advisable for institutions to find OCIO shops that can move quickly and with purpose.

Walk the Walk

If you are a foundation looking to engage with an OCIO provider, how transparent is the vendor? How willing is the potential vendor to give you a look not only at the secret sauce, but how it is made? More times than not, we will supply the investment committee of a foundation, endowment, non-profit or family office with bespoke strategies for the portfolios we would be investing whether or not they hire us. Why? Because that is the right thing to do in order to help the plan. It is my belief the fiduciary is there to assist the client and the beneficiaries of the plans above nearly all else.

Traditional advisors often get into the OCIO business because they think margins are so much more favorable, but they do not realize there are a number of required processes they need to follow in order to succeed. While the consultant may not be an asset manager, the firm most certainly will be acting like one. Therefore, the end client needs to be confident the OCIO vendor provides superb general counsel, compliance and state of the art administrative support. Remember, deciding to hire an OCIO is not the same thing as hiring a traditional non-discretionary advisor. Endowments often get into trouble when they engage with an advisor for OCIO services who is simply not equipped or experienced to manage the workload.

OCIO is one of the fastest growing strategies in financial services because the demand is there from trustees, members of investment committees and the beneficiaries. They are looking to hire people with higher levels of investment acumen who could sit on the same side of the table and become extensions of their investment committees and make decisions not just on a quarterly basis when committees gather, but rather on a daily basis. The issue that many of these organizations face in doing so today is vetting high-quality providers who are going to create alpha and mitigate risk in portfolios when markets are volatile. So, when rates are rising on the fixed income side and the equity markets are clearly dislocating, who these investment committees work with is imperative.

Choosing the right OCIO can be all the difference between adding that extra layer of alpha or having to tell beneficiaries you are repeating ’08 all over again.