State of the Global Economy

- The coronavirus according to the Johns Hopkins Coronavirus Data Map has spread to 156 countries, infecting an estimated 167,519 individuals and causing 6,455 deaths (mortality rate of 3.8%). The spread of the virus has prompted countries to implement widespread containment measures and travel bans which will weaken confidence, consumption and economic growth. Overall, three shocks have hit the global economy: a supply shock from the supply chain disruption, demand shock from health, travel and “social distancing”, and the oil supply shock.

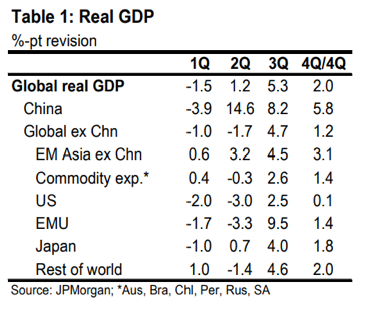

- The economic shocks along with turbulent financial markets and tightening financial conditions are projected to cause a dramatic downturn in growth for 1H 2020. The US and Euro-zone are projected to see Q1 and Q2 in recession, with sectors including transportation, leisure, hospitality, retail and lodging the hardest hit. A recovery in growth during H2, may still leave growth below 1.0% for only the second time since 1982.

- Policy response from global central banks is increasing and spreading. The BoE cut rates by 50 bps, the US Fed cut rates by 150 bps and the ECB announced support for bank lending and an increase in their asset purchase program. JPMorgan forecasts 15 out of 22 emerging market central banks will reduce rates on average of 64 basis through the end of 2020.

- The US government also approved an $8.2 billion spending package to combat the Coronavirus and finalizing the approval of the estimated $50 billion-dollar fiscal package “Families First Coronavirus Response Act. The Act is going to support small- and medium-size business, workers on sick leave, meals for dis advantaged children, free testing for COVID-19 and other provisions, designed to mitigate some of the negative economic impact caused by the virus. Beyond the potential economic benefit, these actions could build support for consumer and business sentiment.

- The US Federal Reserve to bolster liquidity in the financial markets is providing up to $1.5 trillion in financing to the repo market, to ensure the system continues to function without a hitch. The core of the program has the Fed purchasing Treasury securities across the maturity curve and injecting funds into the repo market.

- To get a sense of the impact COVID-19 may have on the US economy, the industry groups projected to be hardest hit and their percentage contribution to GDP are travel and tourism (5.3%), restaurants (4%) and group entertainment consisting of casinos, amusement parks, movie theaters, etc. (1.6%), but note this list reflects a fundamental view as COVID-19 may cause other unexpected changes to consumer behavior.

- China, where the Coronavirus began, is expected to experience a strong rebound in economic activity beginning in March, as the trend of new infections continues to edge downward. According to JPMorgan, Q1 GDP is expected to drop by 3.9%, but a rebound to 14.6% growth in Q2 is expected with the full year growth projection coming in at 5.2%.

- Economic shocks and uncertainty are ubiquitous and are challenging the global economic outlook. The recessionary pressures in H1 will cause global growth to have its weakest showing since the Global Financial Crisis (GFC). The combination of supply chain disruptions, travel restrictions and containment measures, global financial market dislocations and the unprecedented decline in oil could drag global growth in 2020 to below 2.0% if not 0.0%. The dramatically low price of oil could boost consumption growth due to higher purchasing power. The efficacy of monetary policy to bolster the global economy has reached its limits. Developed market governments hold the key in first protecting their citizens from a protracted and virulent spread of COVID-19, and providing strong fiscal policy action to rebuild consumer, business and investor confidence to recover from this lost economic period.

Global Financial Market Dislocation

- Global risk assets suffered their greatest price and fastest bear market decline since the Great Financial Crisis. The precipitous price decline in equities, commodities and non-investment grade credits, and unprecedented decline in global yields and the severe decline in global market liquidity dredged up distant memories from 2008-2009. The OPEC price war and COVID-19 fears prompted an equity market decline on March 9th that triggered the NYSE circuit breakers for the first time since December 2008.

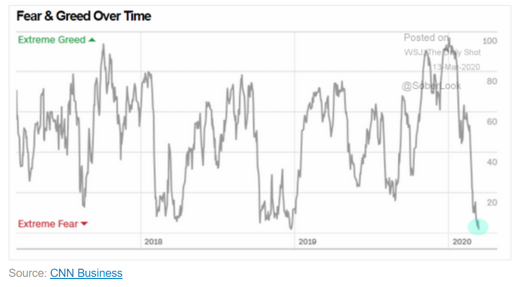

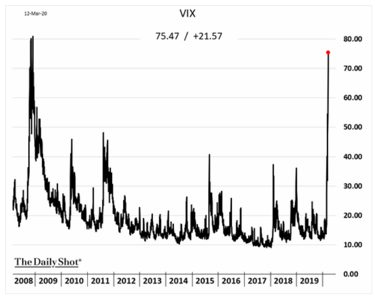

- The global markets hit record highs around February 19, as the S&P 500 topped out on this date at 3386.15. The widening spread of COVID-19 around the global led to a deleveraging by hedge funds, systematic traders, followed by retail investors. This led indicators such as the CNN Fear & Greed Index and VIX hit a multi-year low and high respectively.

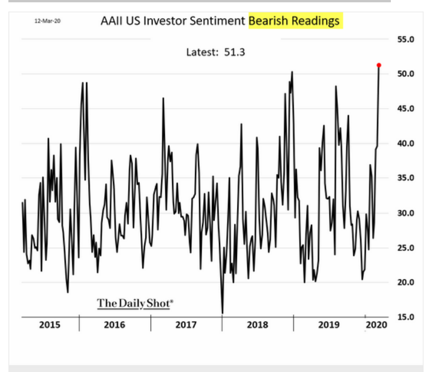

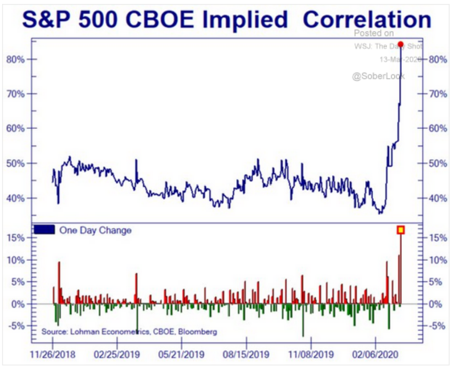

The share of bearish investors in the AAII survey rose to multi-year highs and per the norm, the S&P 500 correlation jumped to almost 90%.

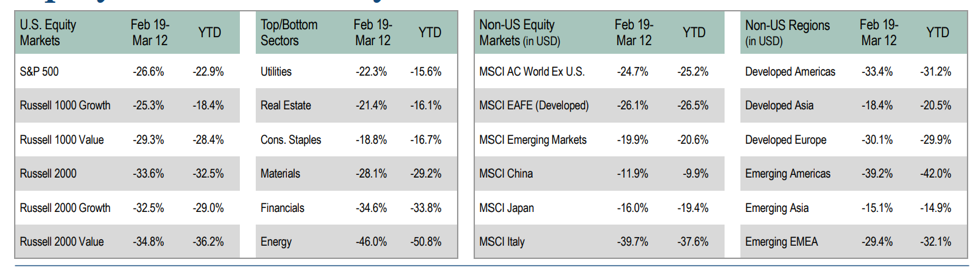

Below is the year to date results of several equity market indices, through Thursday, March 12.

- In the fixed income markets treasury yields were driven to record lows in early March. The 30-year and 10-year treasuries bottomed out on March 9 at 0.692% and 0.380% respectively. The 30-year and 10-year treasuries closed on Friday, March 13th at yields of 1.547% and 0.981%, and remember they began the year with the 30-year yield at 2.283% and the 10-year at 1.823%.

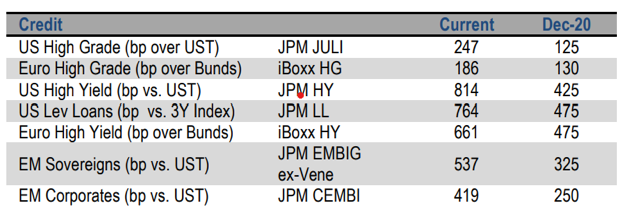

- Outside of treasury securities, the remainder of the US bond market suffered extensive spread widening, even the US High Grade sector widened out to 247. The markets though did not suffer the dysfunction seen during the GFC. Spread levels in December compared to the current levels shown below are eye opening: US High Grade (99 bps), US High Yield (338 bps) and US Leverage Loans (459 bps). The major concern is for a protracted economic downturn which could cause an avalanche of fallen angels, as 48% ($2.78 trillion) of the $5.8 trillion investment grade market is now rated BBB. The market is also wary of the energy sector as it makes up 5.1% and 11.0% of the investment grade and high yield sectors. Should oil remain in the low $30 per barrel level for a sustained period, JPM research is predicting 40% of these energy companies could default within the next three years.

- The aggressive price war between OPEC and Russia has caused oil prices to plunge as low as $31.13 per barrel for WTI (West Texas Intermediate Crude) on March 9, from a high of $63.27 per barrel on January 6. Crude closed at $32.97 last Friday (March 13) and has been partly responsible for the sharp drop in the Dow Jones Commodity Index which is lower year to date by 21.52%. The 20 individual constituents in the Index (energy, agriculture and industrial metal) are all substantially lower as COVID-19 threatens a global economic slowdown.

- The severe bear market price decline in risk assets had investors seeking safe havens in the USD, Yen, Gold and US Treasuries. It seems all of the risk off assets can remain as effective downside hedges, with the possible exception of US Treasuries as they are unlikely to head much higher as US rates are already close to zero.

- After the last week plus of extraordinary market price moves, it seems the investors may be reaching the capitulation levels of December 2018. The outsized decline in equities and US High Grade bonds reflect they are pricing in a recession, while other asset classes such as High Yield and commodities may still have a way to go. But the reset of investor positioning over the past few weeks may provide a base from which to stabilize.

Asset Allocation Decisions: When to Rebalance and How

- The bear market decline in risk assets has many investors underweight risk assets such as equities versus bonds and alternatives. Though it may seem simple to just mechanically rebalance back to our benchmark targeted weightings, we at Clearbrook believe a more fundamentally driven rebalance considering present asset valuations and their intermediate/long term outlook are needed.

- Risk assets led by equities are oversold and will be subject to technical bounces driven by catalyst from policy makers. Volatility will remain, and a sustained rally will not take place until there is a peak and ebbing of new COVID-19 cases (China took four to six weeks), conviction that risk assets are fairly priced to undervalued based on recessionary expectations, and a clearer view on the actual degradation of growth and earnings.

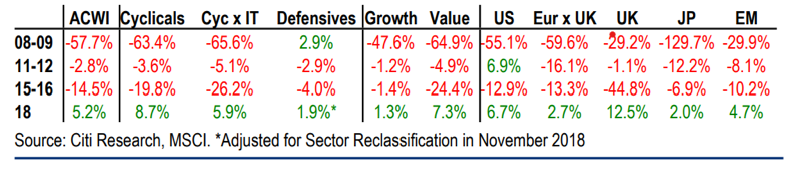

- The OECD has recently downgraded its expectation for global GDP growth from 2.9% to 2.5%. Based on the deleterious effect COVID-19 has and will continue to have on global growth, Citigroup has revised expectations for growth to 2.0%. At this level of growth, Citigroup is projecting a decline of 10% for corporate earnings, should growth drop to 1.5%, then global earnings could contract by 15%. The chart below shows the effect past recessions have had on earnings across countries, regions, industries and investment styles. The important take away is growth tends to hold up better than value, and the US is more resilient than other regions and countries.

- In fixed Income sovereigns are well priced as global rates are near zero or below zero. Securitized and high yield credit have sold off, but selectivity will be key as the expected decline in consumer spending can affect selective sectors such as ABS. Investment grade corporates are attractively priced. We expect the US Fed and ECB to strongly consider re-employment of the term asset backed securities loan facility (TALF) and targeted long term repurchase operation (TLTRO) to provide liquidity and support to markets and businesses.

Recommendation

The economic and earnings damage caused by COVID-19 may last well into Q2. As the impact of the virus on global economic growth, corporate earnings and the behavior/sentiment of businesses, consumers and investors becomes clearer, Clearbrook recommends judiciously rebalancing portfolios from fixed income and alternatives back into equities over several weeks. A simple dollar cost and risk budgeting plan should be employed, with incremental moves averaging 0.50% to 1.00% of the portfolio being redeployed until the benchmark is met or beyond . The program will consider, the proclivity of markets to remain highly volatile, and we will be mindful of relative valuations. Some of the key factors we will consider in the rebalancing program are as follows:

- The emphasis across all asset classes will be quality companies, selling at substantial discounts from their fundamental/intrinsic value, that can weather a downturn should the expected global economic recovery take longer than expected.

- The high correlations seen across asset classes, industries/sectors, securities will decline and has us shift more towards active managers, where superior security selection can add significant alpha versus the passive index funds.

- In equities, we prefer growth, with regional biases to the US and selective Emerging Markets (China and others). We favor large and mega cap names, while high quality small cap exposure can provide excess return.

- In fixed income we prefer the intermediate part of the yield curve, as the curve tends to steepen as central banks lower short-term rates. In addition, longer term rates have already rallied in historic fashion over the past few weeks. We find a great deal of value in the High-Grade Corporate sector due to the recent and outsized spread widening.

- Hedges to downside equity market risk should be maintained via hedge funds, illiquid alternative, gold, the USD and JPY.

Timothy C. Ng

Chief Investment Officer