Economic Data and Market Highlights

U.S. equities advanced moderately over the past week as investors digested mixed economic data and speculated on the timing of future Federal Reserve rate cuts. The S&P 500 gained approximately 1.11% for the week, while the MSCI ACWI, a global benchmark of developed and emerging market equities, rose by 1.74%. In fixed income, the Bloomberg U.S. Aggregate Bond Index edged higher by 0.46%, supported by a slight decline in long-term yields and a tightening in investment-grade credit spreads. Gold reached a new high while bitcoin advanced over 12% hitting $125,000 over the weekend.

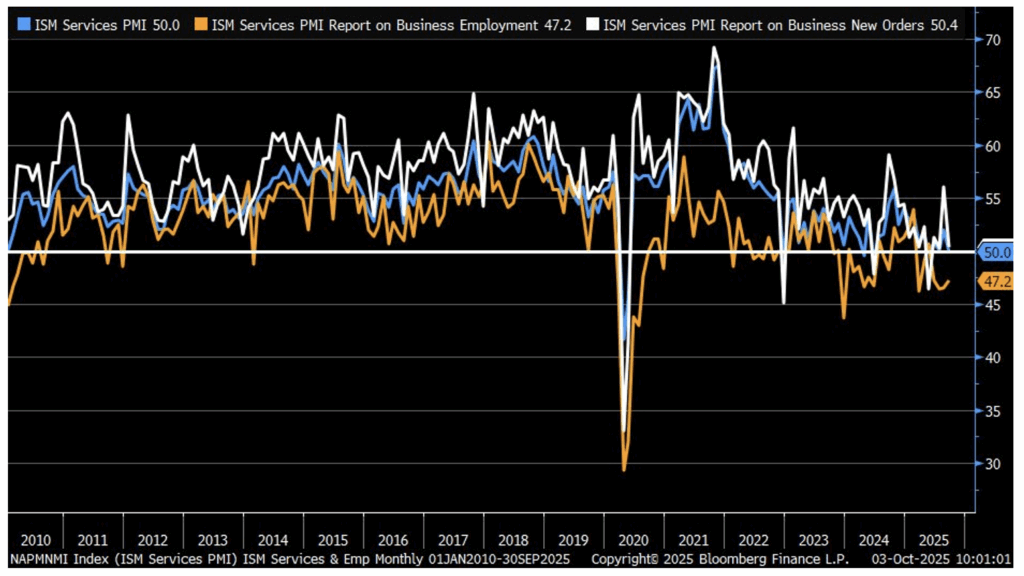

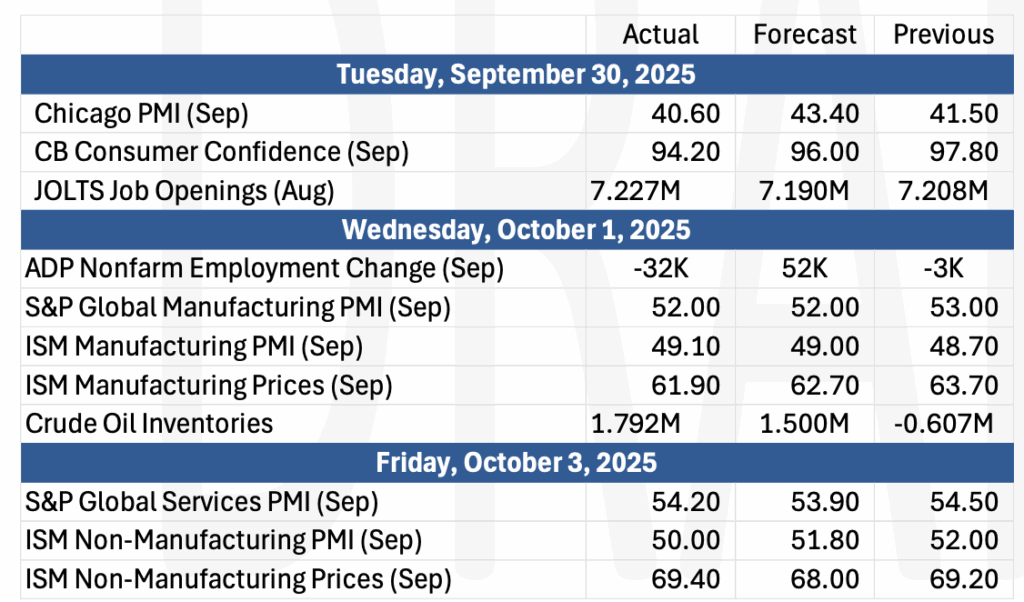

ISM data was a key data point this week. Services came in below estimates. New orders dropped as well. Employment increased slightly, as did prices. While hiring has slowed, employers have not significantly increased layoffs just yet.

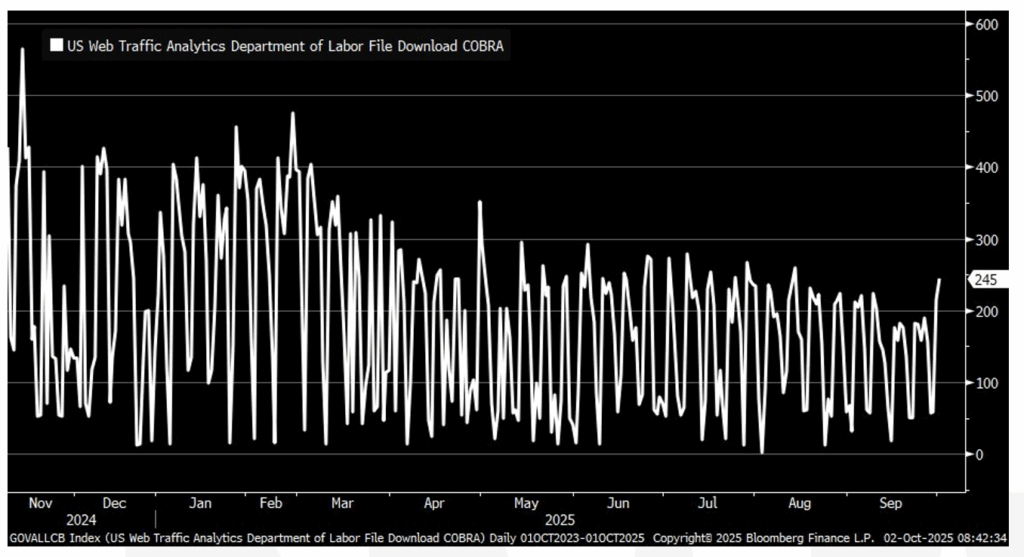

Congress is at an impasse, and at the time of this writing, it is in its fifth day of a government shutdown. As a result, government data related to the economy will be unavailable. The Fed can still act based on private data. ADP and Challenger employment results will be weighted more heavily, with trades and bank earnings playing a key role in understanding the economy. Other examples include looking at web search data, such as below. With no claims data available, trades look to a spike in web search looking for information on COBRA.

The Past Week’s Notable US data points (with revisions)

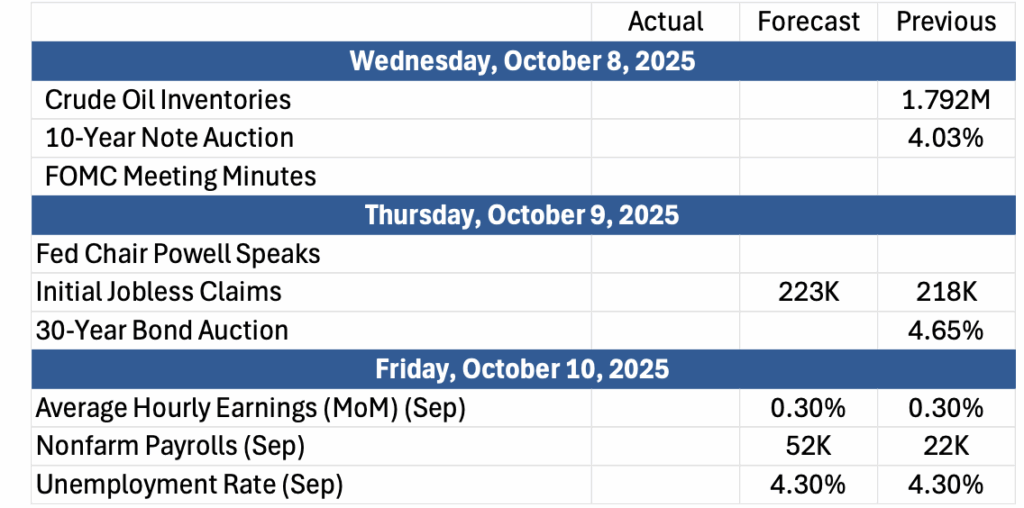

The Upcoming Week’s notable US data points

Some data may not be released due to the U.S. government shutdown

Source: Morningstar

Data Source: Jim Bianco Research, Charles Schwab and Co, Financial News London, Financial Times, Kobelessi Letter Morningstar, MarketWatch, Standard & Poor’s, and the Wall Street Journal.

Authors:

Jon Chesshire

Michael McNamara