Economic Data and Market Highlights

Markets during the week of September 22-25, 2025, reflected the push and pull between resilient U.S. economic data and cautious central bank signaling. Retail sales and core retail sales for August both exceeded expectations, pointing to strong consumer demand, while jobless claims fell more than forecast, highlighting a still-firm labor market. These data reinforced the Federal Reserve’s delicate balance, as Powell emphasized in his September remarks: inflation risks remain elevated even as pockets of softness emerge in labor and manufacturing. New home sales, which surged more than 20% in August to their highest level since early 2022, added another layer of complexity to the Fed’s policy calculus.

Bond markets responded with modestly higher Treasury yields, particularly at the 10-year, reflecting investor sensitivity to supply and monetary policy guidance. The sharp draw in crude oil inventories—more than 9 million barrels—boosted energy prices by around 2%, reviving inflationary concerns. At the same time, discussion about slowing the Fed’s MBS roll-off gained traction, with PIMCO suggesting reinvestment could ease mortgage rates and housing finance costs. Structural developments were also notable: HSBC’s pilot of quantum computing for bond pricing demonstrated early efficiency gains, while Europe’s private credit market continued to accelerate, raising $25.7 billion through March, underscoring its growth potential compared with the U.S.

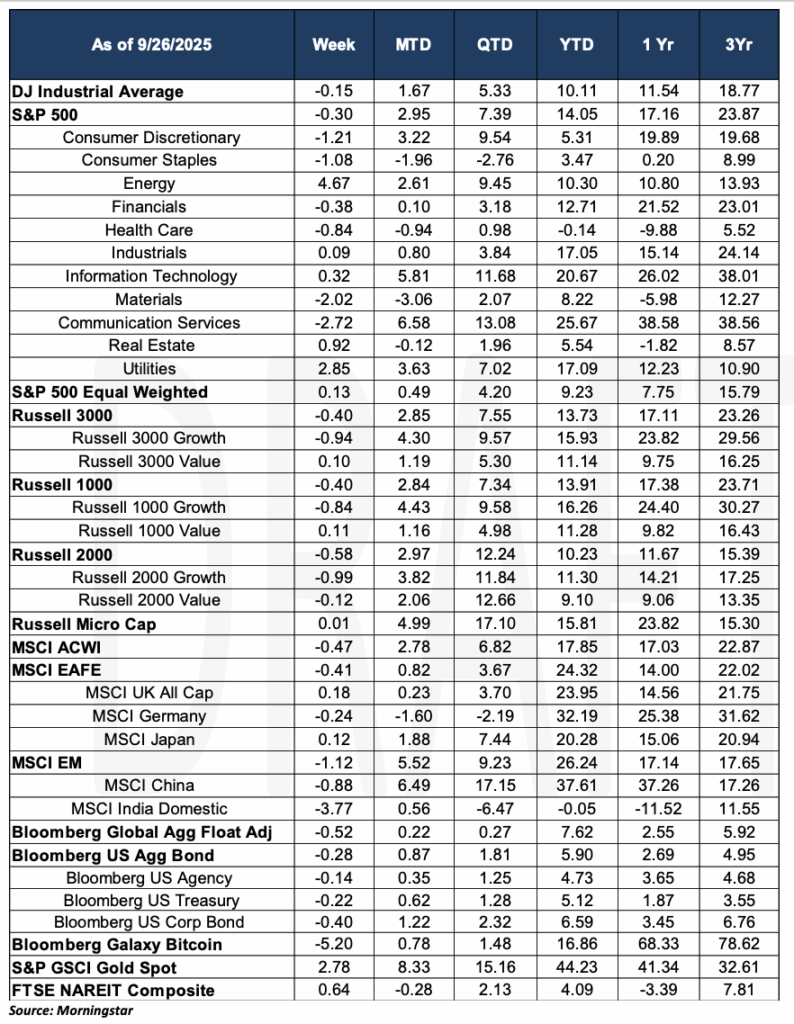

U.S. equities cooled after setting fresh highs early in the week. Friday’s in-line inflation readings helped indexes rebound intraday, but the S&P 500 still finished the week down about 0.3%, snapping a three-week winning streak as investors weighed the Fed’s first rate cut of the year against sticky-ish price pressures and fresh tariff headlines. Breadth was mixed: mega-cap tech steadied, while cyclicals lagged amid growth jitters and shutdown chatter. Globally, risk appetite was similarly cautious. The MSCI ACWI dipped ~0.30% for the week (total return), reflecting earlier highs followed by broad consolidation as Europe traded flat and Asia softened. Investors continued to parse whether AI-led earnings strength and expected Fed follow-on cuts in October/December can offset rich valuations and policy uncertainty.

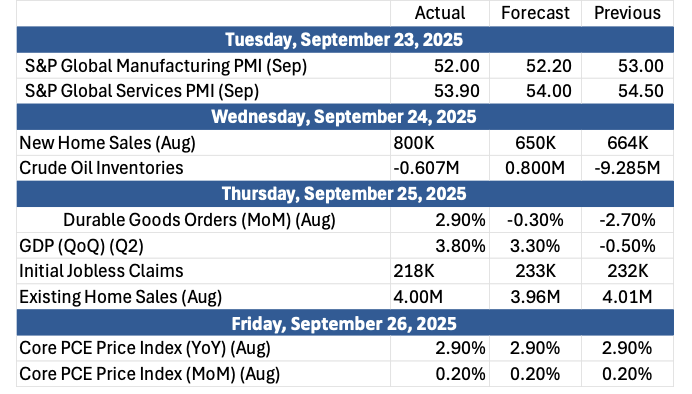

The Past Week’s Notable US data points (with revisions)

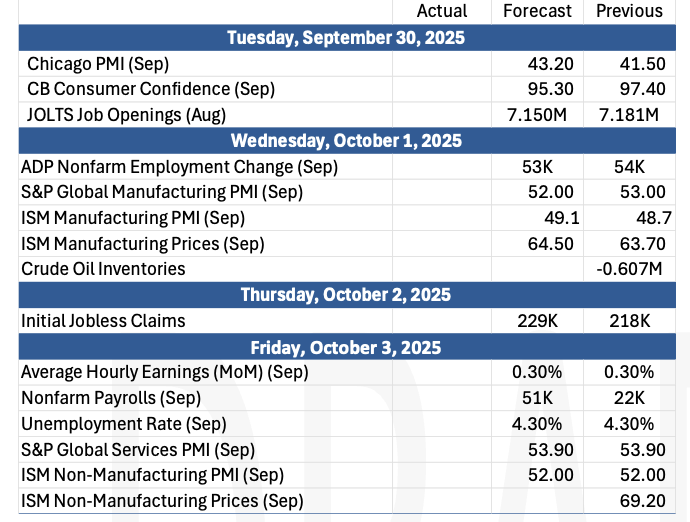

The Upcoming Week’s notable US data points

Data Source: Jim Bianco Research, Charles Schwab and Co, Financial News London, Financial Times, Kobelessi Letter Morningstar, MarketWatch, Standard & Poor’s, and the Wall Street Journal.

Authors:

Jon Chesshire

Michael McNamara