Economic Data and Market Highlights

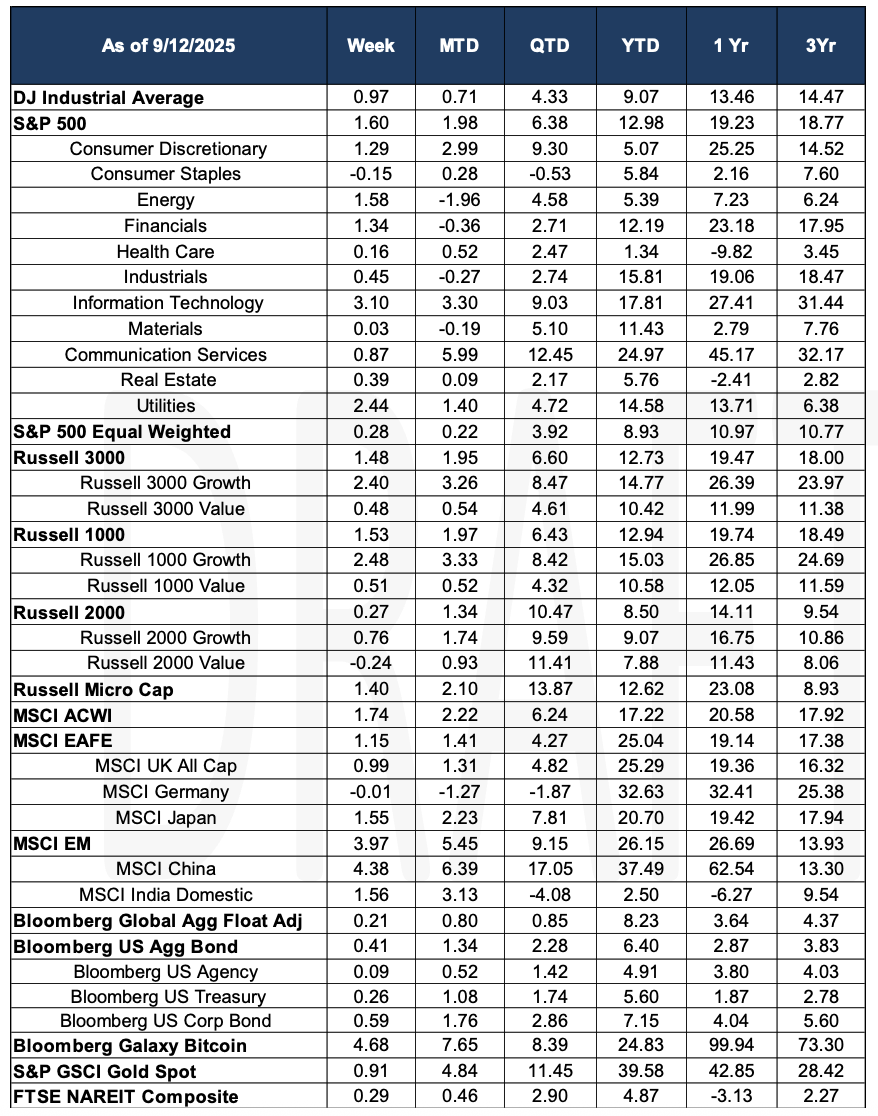

Global markets showed notable resilience despite mixed economic signals. A softer-than-expected U.S. jobs report fueled expectations of Federal Reserve rate cuts, helping global indices like the MSCI ACWI ( up 1.74%) reach new highs. The rally extended beyond U.S. technology leaders, even as the “Magnificent Seven” faced margin pressure from capital-intensive investments in AI. In China, a 10-year bond yield of nearly 1.8% suggests that recent policy stimulus may be gaining traction, offering potential upside for local markets. Meanwhile, Oracle surged on strong AI-cloud momentum, while broader emerging-market flows revealed a divergence: nearly $39 billion into Chinese assets contrasted with $7.4 billion in outflows from non-China EM equities.

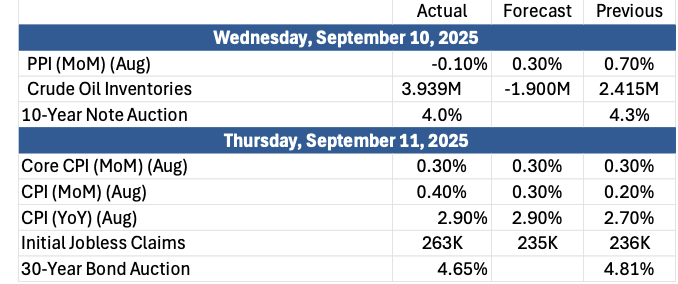

Fixed-income markets were equally active, with U.S. producer prices dipping 0.1% in August on weaker services and energy costs, reinforcing dovish Fed expectations. Strategists surveyed by Reuters overwhelmingly anticipate a steepening Treasury yield curve by year-end as fiscal risks and inflation uncertainty loom. The 30-year fixed U.S. mortgage rate fell to 6.49%, an 11-month low, signaling potential support for housing demand. Japan added volatility of its own when Prime Minister Shigeru Ishiba resigned, pushing long-term JGB yields to multi-decade highs and raising speculation of a return to aggressive monetary easing and fiscal expansion.

Beyond traditional asset classes, alternative investments gained traction. “Bowie bonds”—debt securities backed by music royalties—hit a record $4.4 billion in issuance this year, drawing major institutional backing and credit ratings that enhance credibility. Investors are attracted to their predictable, streaming-driven cash flows and yields above similarly rated corporates. Meanwhile, oil markets absorbed OPEC+’s modest October output increase of 137,000 barrels per day, a symbolic shift toward reclaiming market share rather than aggressively defending prices. Saudi Arabia also continued its strategic pivot toward renewables, expanding solar and battery capacity in pursuit of its 2030 clean-energy targets.

The Past Week’s Notable US data points (with revisions)

The Upcoming Week’s notable US data points

Source: Morningstar

Data Source: Jim Bianco Research, Charles Schwab and Co, Financial News London, Financial Times, Kobelessi Letter Morningstar, MarketWatch, Standard & Poor’s, and the Wall Street Journal.

Authors:

Jon Chesshire

Michael McNamara